Knowledge Base

WebAR (Web-Based orBrowser-based AR (Augmented Reality)) works by having a user scan a generated QR Code, or open its corresponding URL and being able to recognize a single (1) 'Web-Based-AR enabled artwork', or a folder containing up to ten (10) 'Browser-Based-AR enabled artworks', without even needing to download our App. Anyone with theURL can recognize the WebAR artworks the experience contains.

If you would like to be able to recognize all artworks, regardless of whether they are WebAR-enabled, or you don't want to rely on a QR code, use our standalone iOS or Android App.

How do I use WebAR?

If you don't know, how to use WebAR, then please check out this link to one of our examples. It shows you how it will look alike. You can try it out, test it as much as you want.

Make sure - if you want to test WebAR - delete the Artivive App from your iPhone (otherwise the QR-Code from WebAR just opens up the Artivive App and you see your artwork in the Artivive App).

Get Started with WebAR

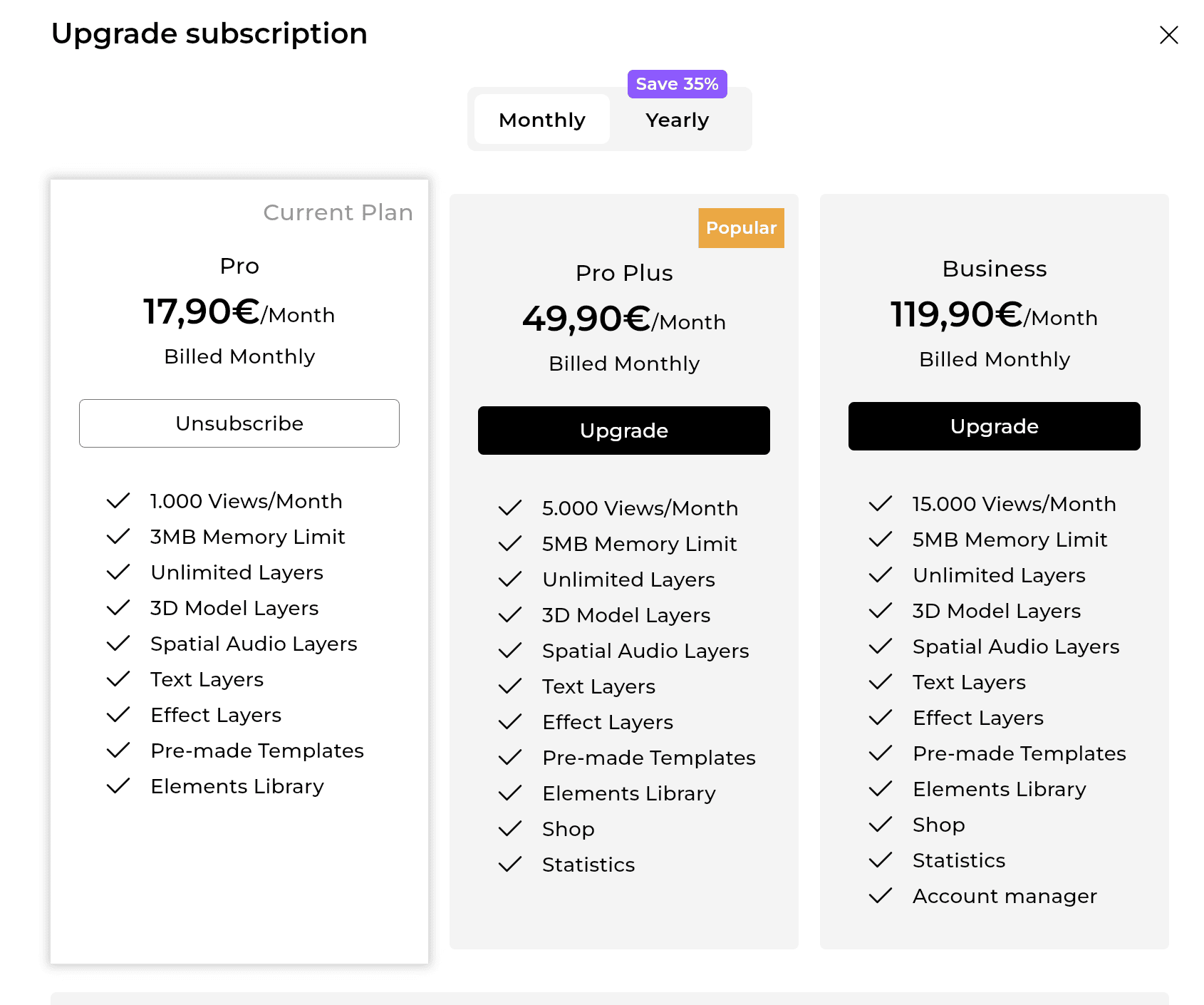

To get started, you will need at least a 'Pro Plus' or, even better, a 'Business' Artivive Bridge Subscription. You can check more details on our pricing page. After purchasing the subscription, you can enable a specific (working) artwork in your account by opening the respective options menu and selecting 'Publish as WebAR'. The artwork must not contain any errors for it to be recognizable. That's the case for both, WebAR and our standalone Artivive app (iOS Store or Google Play).

If you have a folder containing up to ten (10) artworks, you can also enable all of them at once by opening the folder options menu and selecting 'Publish as WebAR'. Note that if an artwork is moved in or out of the folder, it will not change their respective Browser-Based Augmented Reality status. It just means the Browser-Based-AR URL will contain different artworks inside.

How can I add an artwork to an existing Browser-Based Augmented Reality folder to expand my experience?

If your folder contains less than ten (10) artworks inside, you can simply move 1 artwork more inside and select 'Publish as WebAR' on the artwork itself, or the folder. The URL won't change, so there won't be any disruptions.

If it already contains more than ten (10) artworks, you will need to move one of them out before adding another one inside. No need of deleting it - you simply could place it into another folder.

How can I update an artwork that is already part of an existing Web-BasedAugmented Reality experience?

You can update your artwork as you would normally do, and then simply reload the WebAR page to get the latest version.

How can I unpublish my artworks from WebAR?

If you have shared the QR Code, or its corresponding URL, of one of your Web-Based Augmented Reality experiences, and would like to prevent further engagement, you can open the respective options menu, select 'Manage WebAR', and then select 'Disable WebAR' on the top right corner. The same applies to a WebAR folder experience.

What happens to my Web-Based Augmented Reality artworks if I unsubscribe?

Web-Based or Browser-Based Augmented Reality needs an active Pro Plus or Business Artivive Bridge Subscription. If you unsubscribe and are back to a Free account, you will not be able to scan the WebAR artworks anymore.

Are views counted with WebAR?

Yes, views work exactly the same way they do with the standalone iOS and Android App.

What are the limitations of Web-Based Augmented Reality?

The main limitation compared to Artivive's standalone iOS and Android App is the native performance and stability. Other than that, in this first WebAR Alpha release, the artworks are not a 1-to-1 match to the standalone App. As always, please make sure to test your artworks with the WebAR player before sharing it. Limitations include:

- The styling of Text Layers (e.g., bold, color, italic) is mostly missing

- No support for Particle Layers

- Only one (1) Video Layer with audio can be played on iOS. This is a restriction from Apple, so keep it in mind

- iOS Video Layer audio only plays through App Clips, so be sure to share a QR Code to be detected as such

- (3D) Audio layers' volume might be a bit off.

As the views will become the new currency we will have to give the paying users full control over costs.

Measures for keeping the control over the costs and the artwork active:

Add-on

The add-on is a one-time payment that gives you additional views for the month.

- 2.000 views – € 19,90

- 5.000 views – € 49,90

- 10.000 views – € 99,90

Overage (cost control)

For cost control, the user will have to set an additional cost limit for the account/month. This will be the amount until the account can be charged for over-usage (more views than in the upgrade). The amount can also be 0.

Upgrade

All our plans/subscriptions are monthly priced and can be changed or canceled at any time. To encourage long-term commitment and help us better plan we offer a discount of 17% for yearly plans.

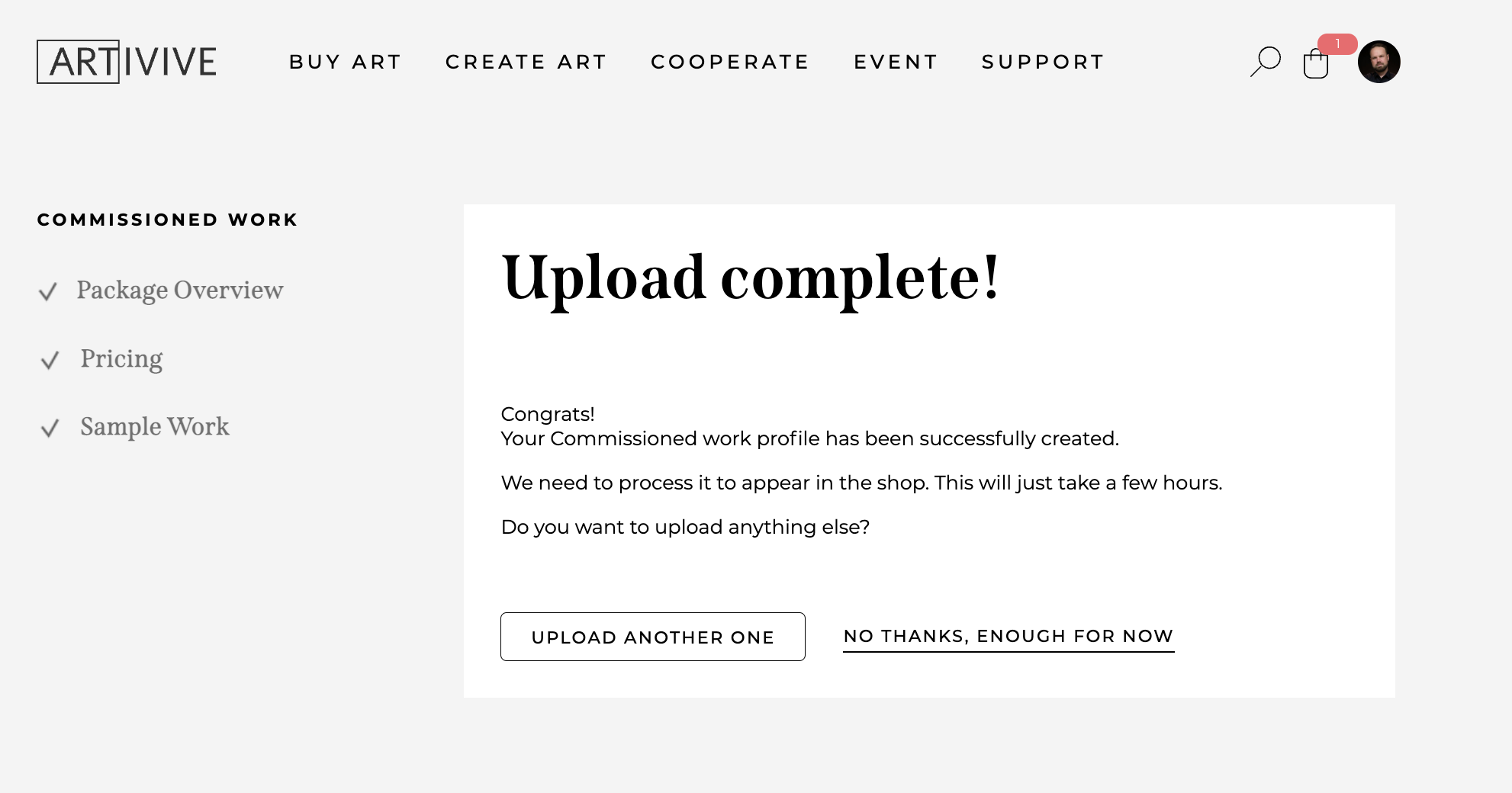

1. Create an Artivive account and subscribe to Pro Plus or Business subscription.

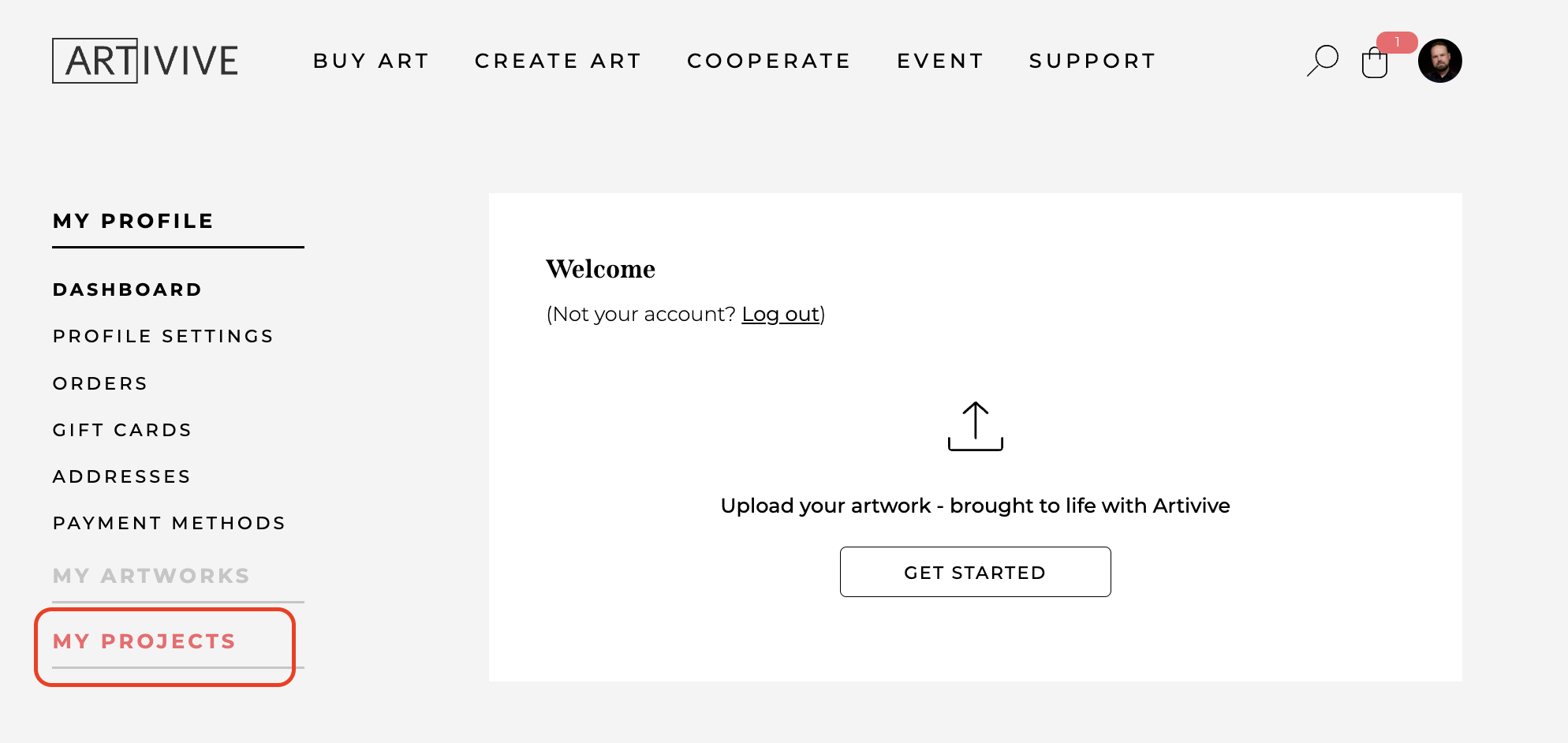

2. Go to your profile and click on « My projects »

3. Click on « Get started »

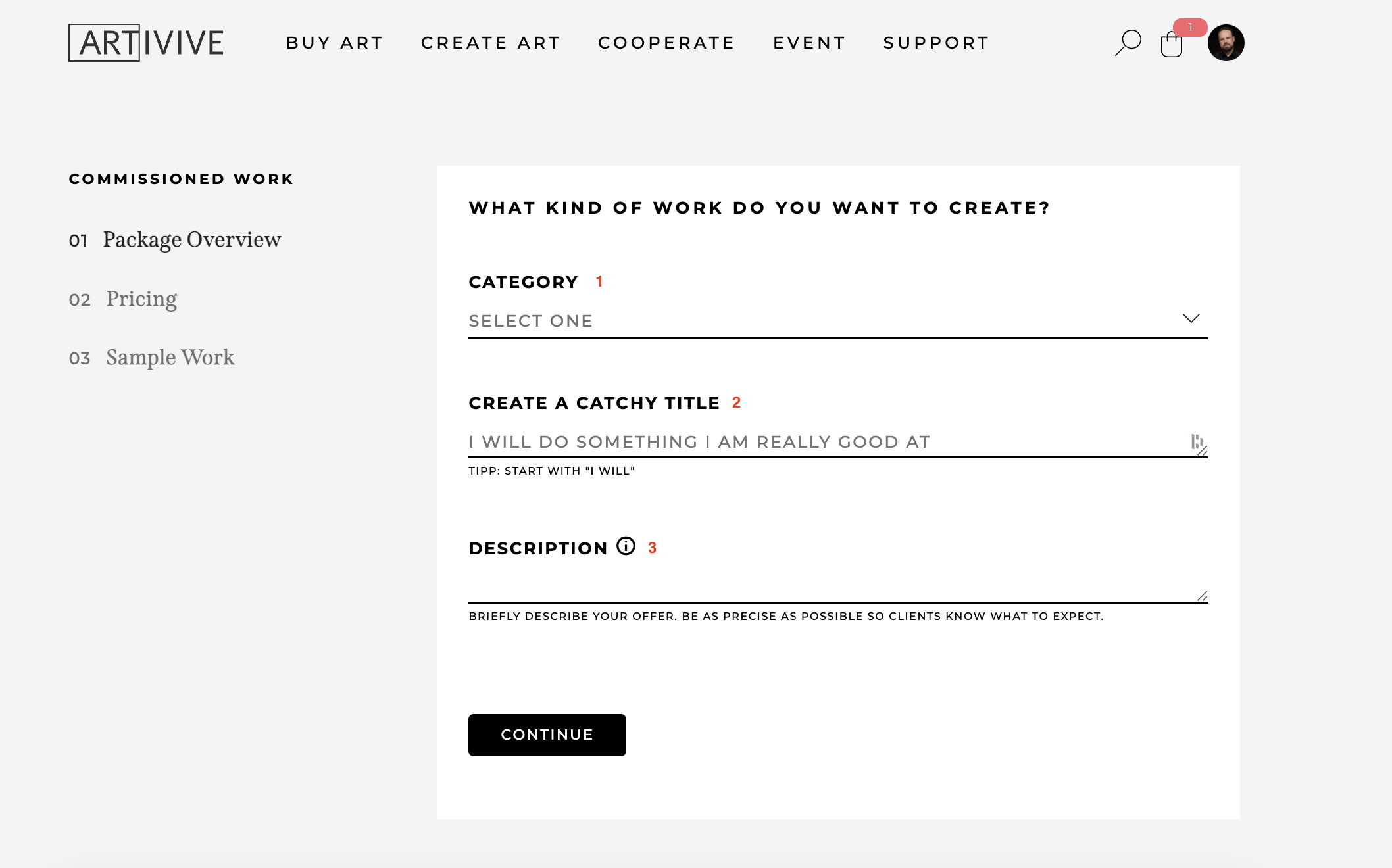

4. Select a category between «Original Artwork enhanced with augmented reality» and «Animation of existing artwork»

- Give a title to your service

- Add a description in order for the visitor to have a full understanding of your skills!

Click on continue

5.

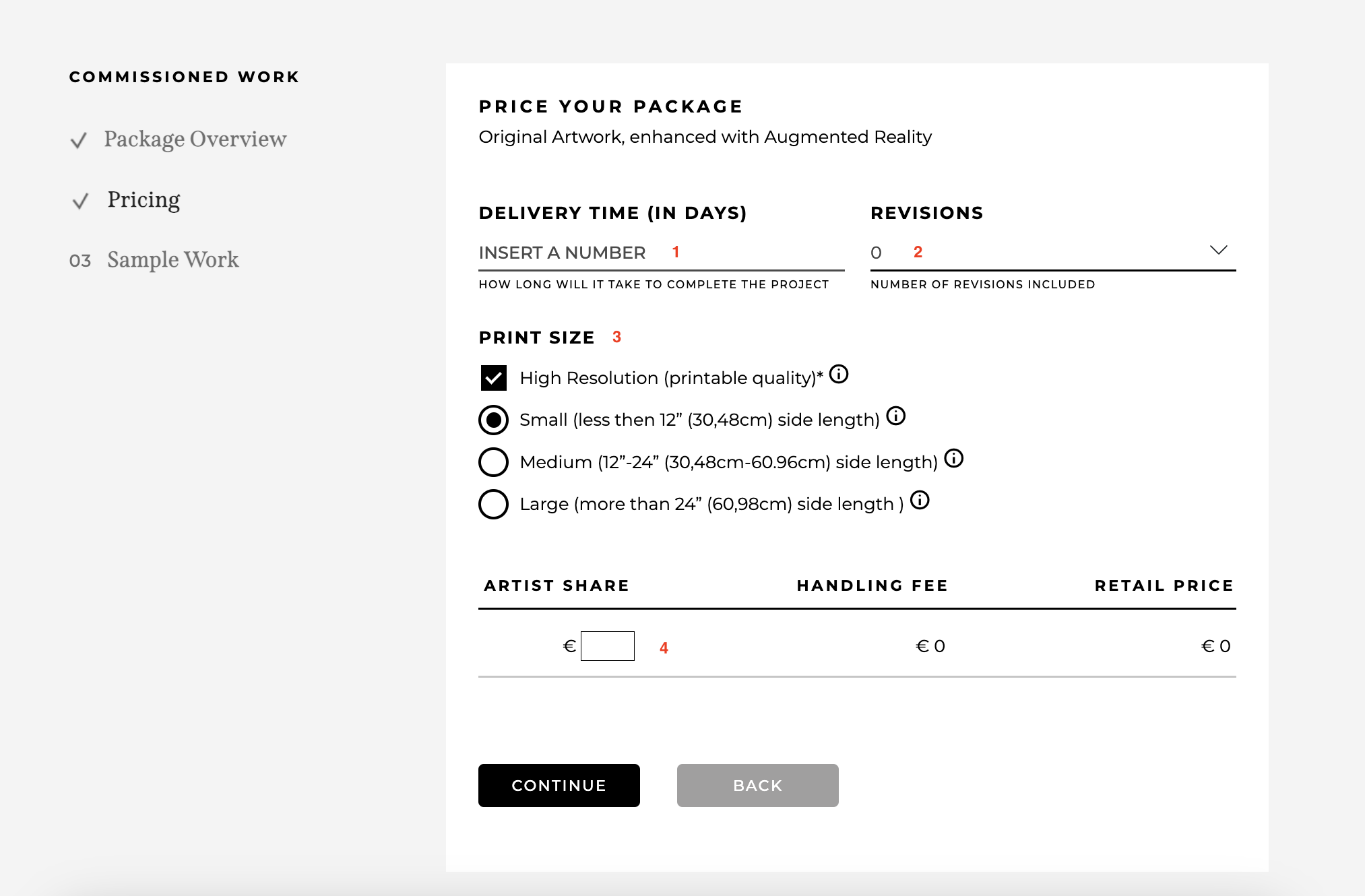

- Give a delivery time in days

- Fill in the number of revisions you will allow

- Select the size of the art

- Fill in the (commissioned)share you would like to receive with this service

- Click on continue

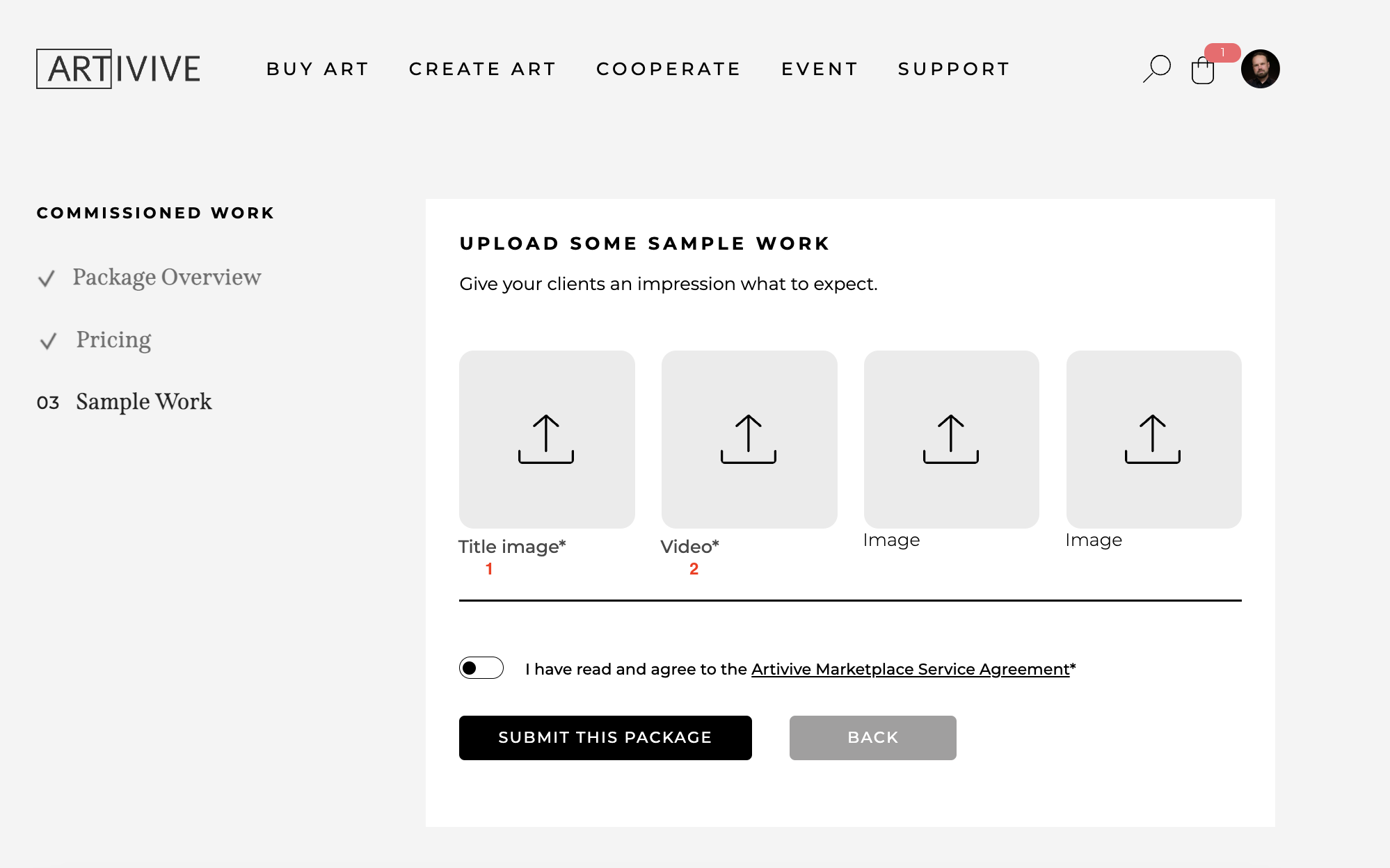

6. In the next step, you need to upload an example of your work.

You will need to upload your art and the animation if you are creating a profile for animation. (1 and 2)

Once you agree to the terms and conditions, you can proceed to the next step.

7. Your profile is now finished! You can access it whenever you want by clicking on your profile picture or directly on this link: https://artivive.com/comissioned-ar-artworks/

You can create another product if you want!

If you have any questions, you can contact us at support@artivive.com

What is the product’s retail price?

The retail price is the amount the customers are charged for a product. The retail price is determined by the minimum price which includes production, shipping and a handling fee plus the artist share.

Depending on the billing address and the laws of the respective country the retail price will vary.

Do Artivive’s product prices include tax?

The prices you see on our product pages include applicable tax, prescribed by the Austrian tax law. The final price you pay will be calculated in the checkout based on the country’s regulations and laws of the shipping address and may be different from the listed price.

Customers inside EU:

The amount of VAT to be charged is based on the regulations and laws of the respective country. VAT charges for your order will be itemized on the last page of your order, in the e-mail confirmation of your order and on the invoice dispatched with your order.

Customers outside EU:

For dispatch to countries outside the EU you may be charged VAT, or other taxes, as required by the country of delivery or alternatively, the packages may be assessed for import or customs fees, depending on the laws of the country concerned.

If customs or import duties are levied, these are payable once the package reaches the destination country. Additional charges for customs clearance will have to be borne by the recipient. We have no control over these charges and can’t predict what they might be. Customs regulations vary greatly from country to country. For further information please contact your local customs authority.

What is Artivive Shop?

Artivive Shop is our artist community and online sales platform for augmented reality art. As an integrated part of our website, it is a place where artists can create a profile, upload, and show their AR artworks to our community and a worldwide audience. With Artivive Shop we built a platform for artists to discover and engage with other artists, see and be seen, get jobs in the AR art field, and sell art prints online. With a Pro plus or Business subscription you have access to create a Artivive Shop seller profile.

What’s in it for me?

With an artist profile, you can upload and sell your AR artworks as high-quality art prints, online over our platform.

Artivive Shop also acts as a broker and facilitates collaboration between artists and paying customers, such as open calls, exhibitions, or commissioned work.

How can I start selling AR artworks on Artivive Shop?

All Pro Plus and Business subscribers will automatically receive an email with registration to create an artist-seller account for the Artivive Shop. You can then begin selling their AR artworks in high-quality prints and receive the additional benefits that come with the subscription. (see below for additional benefits). You can upgrade your account at any time.

*Artivive Shop account is not directly connected to Bridge. It is a separate account, log in, and upload of artworks.

What is an Artivive Shop seller account?

Users with a Pro Plus or Business subscription (artivive.com/pricing) can create an artist profile on Artivive Shop and exclusively benefit from the service.

How many views are included?

Unless otherwise explicitly regulated in your Custom account, a Pro Plus account includes 5,000 views per month.

What are the additional benefits?

Additionally to the 5000 views per month, the Pro Plus subscription gives you the artist seller account to start selling your artwork in high-quality framed prints, get recognized and be asked to make commissioned artwork, have access to exclusive events, and receive discounts for workshops and other community events. You will also gain access to statistics, and other benefits on Bridge.

Are all my artworks on Bridge automatically listed on Artivive Shop?

No. You are in full control of which and how many artworks are listed on Artivive Shop, as an artwork has to be uploaded to the Artivive Shop additionally.

Artivive Shop is not directly connected to Bridge. It is a separate account, log in, and upload of artworks.

What exactly are you selling?

High-quality framed art prints.

What frame/paper sizes are available?

We offer the following paper sizes

inch: 8″x10″, 10″x10″, 12″x12″, 12″x16″, 12″x18″, 14″x14″, 16″x16″, 16″x20″, 18″x18″, 18″x24″, 24″x36″, 10″x8″, 16″x12″, 18″x12″, 20″x16″, 24″x18″, 36″x24″

cm: 20×25, 25×25, 30×30, 30×41, 36×36, 41×41, 41×51, 46×46, 46×61, 61×91, 25×20, 41×30, 46×30, 51×41, 61×46, 91×61

Please make sure to keep the paper sizes in mind when uploading your artwork to Artivive Shop. The maximum size is 20000 px, and all the artworks should be more than 100 DPI (biggest size).

Paper type/quality options:

We offer framed posters, printed on Enhanced Matte Paper or Premium Luster Photo Paper.

- Enhanced Matte Paper:

Framed Poster printed on thick, durable, matte paper.

Paper thickness: 10.3 mil (0.26 mm)

Paper weight: 5.57 oz/y² (189 g/m²) - Premium Luster Photo Paper:

Epson Ultra Premium Luster Photo Paper has between a gloss and matte finish, giving you a highly saturated look and maximum ink coverage. Due to its rich colors, luster paper is a popular choice for giclée quality photographic prints..0 mil (0.25 mm) thick paper

Paper weight: 7.67 oz/yd² (260 g/m²)

Frame option:

The matte black frame that’s made from wood from renewable forests adds an extra touch of class.

- Ayous wood .75″ (1.9 cm) thick frame from renewable forests

Acrylite front protector

Lightweight

Hanging hardware included

Price calculation: How much do I get from a sold art print?

You define your share! We ask for a minimum price that covers production and shipping costs as well as a small handling fee. You can freely add your asking price on top and thus determine the retail price.

How do I get my share?

The payout of the artist share is fully handled by PayPal – we do not store any card details. That means we need you to provide your PayPal email address. Payouts take place after an order was completed.

What happens to the artwork after a sale?

To guarantee the best experience for the buying customer, we grant unlimited views to every artwork sold via Artivive Shop. That means it does not affect the views count of your account. The artwork will remain editable in your Bridge account. We will not restrict your artistic license, even after a sale.

Can I sell my art elsewhere too?

Yes. Artivive Shop is non-exclusive and the intellectual property rights of course remain with the original owner (the artist).

French:

Tutoriel de Réalitée augmentee | Réalitée virtuelle | Avec Artivive | Tuto n°1

Tutoriel artivive de Realitée Augmentee Francais | Réalitée virtuelle | Réalitée augmentée | n°2 ✔

German:

Augmented Reality Tutorial – AR Kunst kostenlos mit Artivive erstellen (DEUTSCH)

Italian:

ARTI VIVE con ARTIVIVE, APP PER REALTÁ AUMENTATA

Thai:

สร้าง AR ด้วย Artivive ใน 10 นาที

Japanese:

Artivive Community Tutorial: How To Create An AR Artwork By Karezmad (In Japanese)

AR-Step-by-Step Guide: How to create Augmented Reality Art

How To Create Art In Augmented Reality With Bridge By Artivive

How To Do A Stop Motion Animation

How To Use The 3D / Pro Mode

How To Optimize Image Recognition

How To Create AR Art – Basic Mode Bridge

Creating Augmented Reality Art With 3D / Pro Mode

How To Bring Your Sketches To Life With Augmented Reality

How To Create Augmented Reality Art

How To Bring Your Portrait To Life

How To Make An Animated Illustration

How I Add Augmented Reality Video To The Johnny Dollar Bill

Creating An Augmented Reality Artwork With Artivive

Artivive Augmented Reality Tutorial “The Malt Shop”

Artivive offers one type of account with upgrade and add-on possibilities. This account is a freemium account – any creative can sign up and use it for free up to a certain number of scans (views).

Once you register, you will be assigned a free Artivive Creator Account, also known as Basic. With the Basic account you have a lifetime of 50 views. Once you have created your account you can then upgrade to one of our higher subscription tiers for more creative fun and benefits!

You can start with a 14-day free trial for the Pro subscription allowing you and your audience to experience your AR creations with views that renew each month.

You are able to upgrade or downgrade your account according to your needs and wishes at any time.

You can find an overview of Artivive subscription on our pricing page.

All our plans/subscriptions are monthly priced and can be changed or canceled at any time. To encourage long-term commitment we offer a discount of up to 35% for yearly plans, allowing you to save big if you opt for one of our yearly plans. The monthly or yearly subscription will renew automatically.

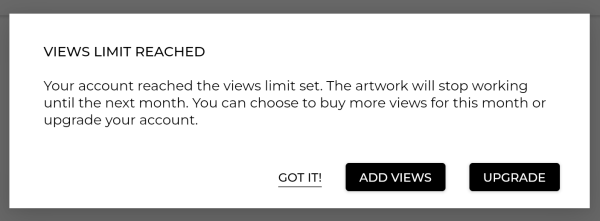

VIEW LIMITS

Your Bridge account allows you to upload an unlimited number of artworks. However, there is a monthly view limit that applies to the total number of times all artworks in your account can be viewed. The number of views included in your subscription/plan applies to your entire account and not to each individual artwork. For instance, if you have a Pro plan with a monthly limit of 1000 views, you can view all of your artworks a total of 1000 times per month.

• You can see how many views you used in the current month on the bar in under your Bridge profile.

• Once the monthly view limit has been reached, you will receive a pop-up message in your Bridge account (see below). When this happens you have several options:

- Holders of the basic plan are able to upgrade their subscription, this way the number of your monthly views will increase and the artworks in your account will stay active. If you do not upgrade, the artworks in your account will be temporarily deactivated (you can edit them, but you will not be able to scan them with Artivive App). The artworks will be activated automatically when the views count resets (new month).

- Holders of pro, pro plus, or business account, can choose between upgrading their plan, adding additional views (more information below), or setting a cost control, where you will be charged per view after using all your available views (more information below).

• Emails will be sent when: 50%, 80%, and 100% of the limit is reached, the add-on was added, and/or the artwork was set inactive to not generate any more costs.

IF YOU REQUIRE MORE VIEWS CHECK HOW TO ADD ADDITIONAL VIEWS!

Special upgrades

Educational / Enterprise upgrade

The accounts that don’t fit as business accounts or have other needs – educational institutions, NGOs, museums, etc. They will be administered and invoiced separately based on the offers Artivive made. Here we will not have public price lists. Based on regions and needs we will have different offerings.

FAQs:

- Who can register and use this account?

Every creative (artist, musician, designer, …) who wants to use Artivive for their artworks. At the registration, the creatives will be asked to share with us an online portfolio (website, Instagram, Behance, …). - What happens if I reach the limit of my views?

For Basic ACA – After the 50 lifetime views have run out your artwork will be disabled. There will be a message in the app that the limit was reached. For Paid ACA – the artwork will also be disabled after your views limit has been reached but you have the option to purchase add-ons or add to your cost control. For paid users these views will reset each month and for free accounts you only have the 50 lifetime views. - How can a user have an overview of the scans left?

There will be a bar in the dashboard on Bridge. - How does the free trial work?

We offer a free trial for our subscriptions, which gives you an opportunity to try out all of Artivive‘s pro features. The trial is 14 days long, and after the 14 days the selected subscription will automatically continue. Please note, that you have to unsubscribe during your free trial (14 days) if you do not want to the subscription to continue. - How will the statistics work?

The views per artwork will reset each month. Only ACA Pro Plus and Business users will be able to see the total number of views and detailed statistics. - What should happen if there are any payment problems?

The account will be set on Basic until it’s solved. - How do we handle an up/downgrade in the middle of the pay cycle?

For upgrades, you will automatically be billed on that day for the new tier and will receive all features and new number of views. You will only have to pay the difference. The next billing cycle will be a month after the upgrade. Downgrades will be for the next billing cycle. - Would it be possible to put some artworks on pause so that they don’t get any scans or views?

Not at the moment. - Would it be possible to see your invoices?

Yes, invoices will be available in the account’s info.

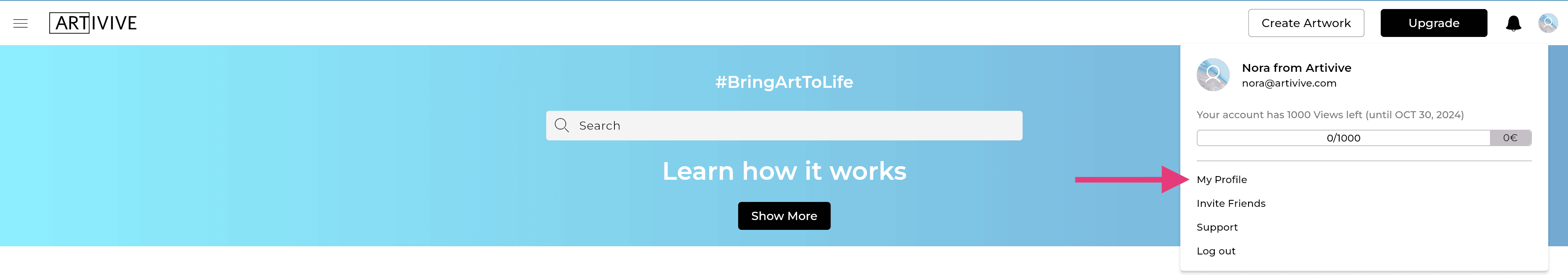

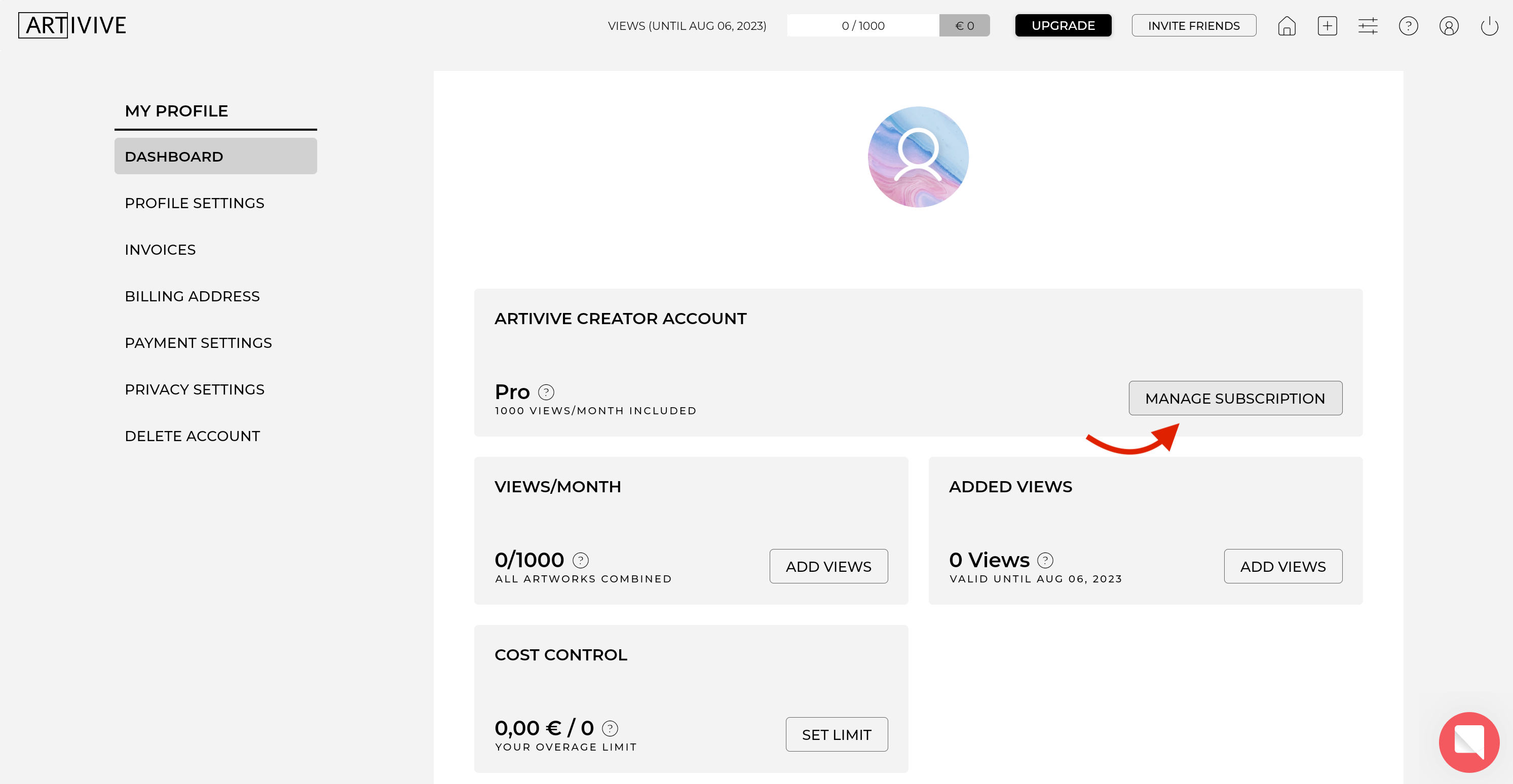

Cancel subscription

You can cancel your subscription at any time by visiting your Bridge profile dashboard and clicking on “manage subscription”. The change will occur in the next billing period. If you would only like to deactivate your subscription for a short period, we offer you an option to pause your subscription.

Pause subscription

You are able to pause your subscription for up to 3 months. You can do so by proceeding to unsubscribe and selecting the pause subscription option when offered. The subscription will automatically continue after the time period you paused it for ends.

Delete Account

You can delete your account by visiting your profile and selecting the “delete account” option from the list. Once you delete your account, all your artworks will be deleted and you will not have access to the account anymore.

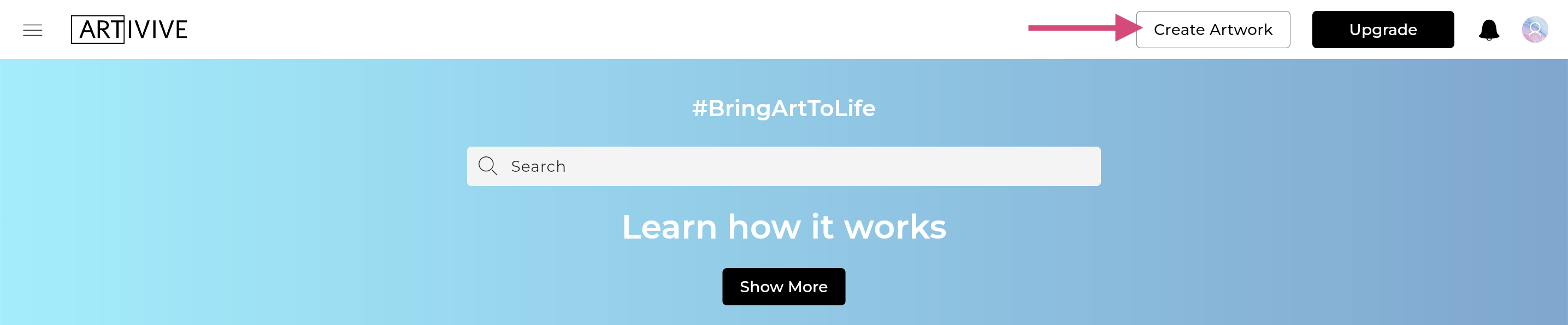

Creating Augmented Reality Art with Artivive is fast and easy. No coding or programming experience required! Watch the full tutorial here.

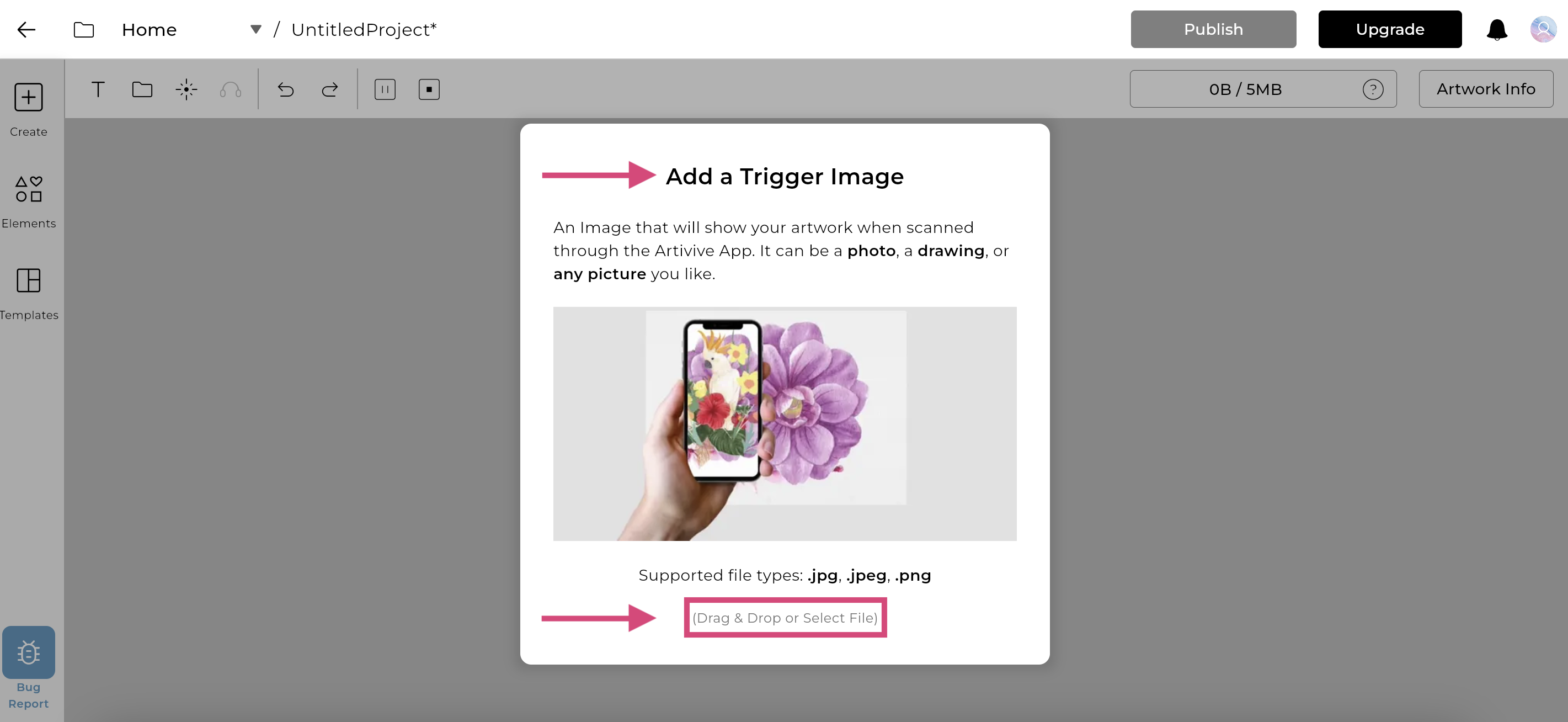

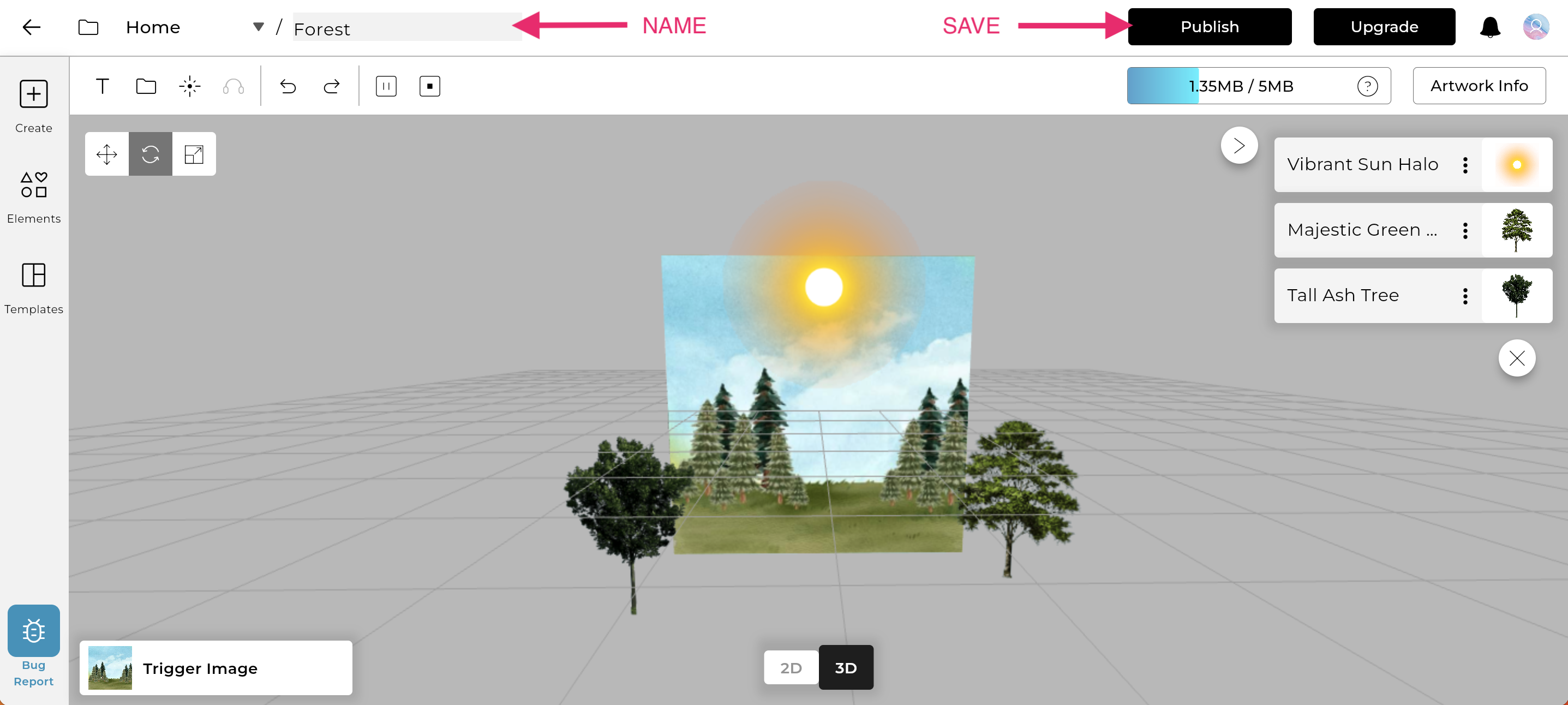

If you open your Bridge account and click the “Create Artwork” on the top right-hand corner, you will automatically be redirected to the editor.

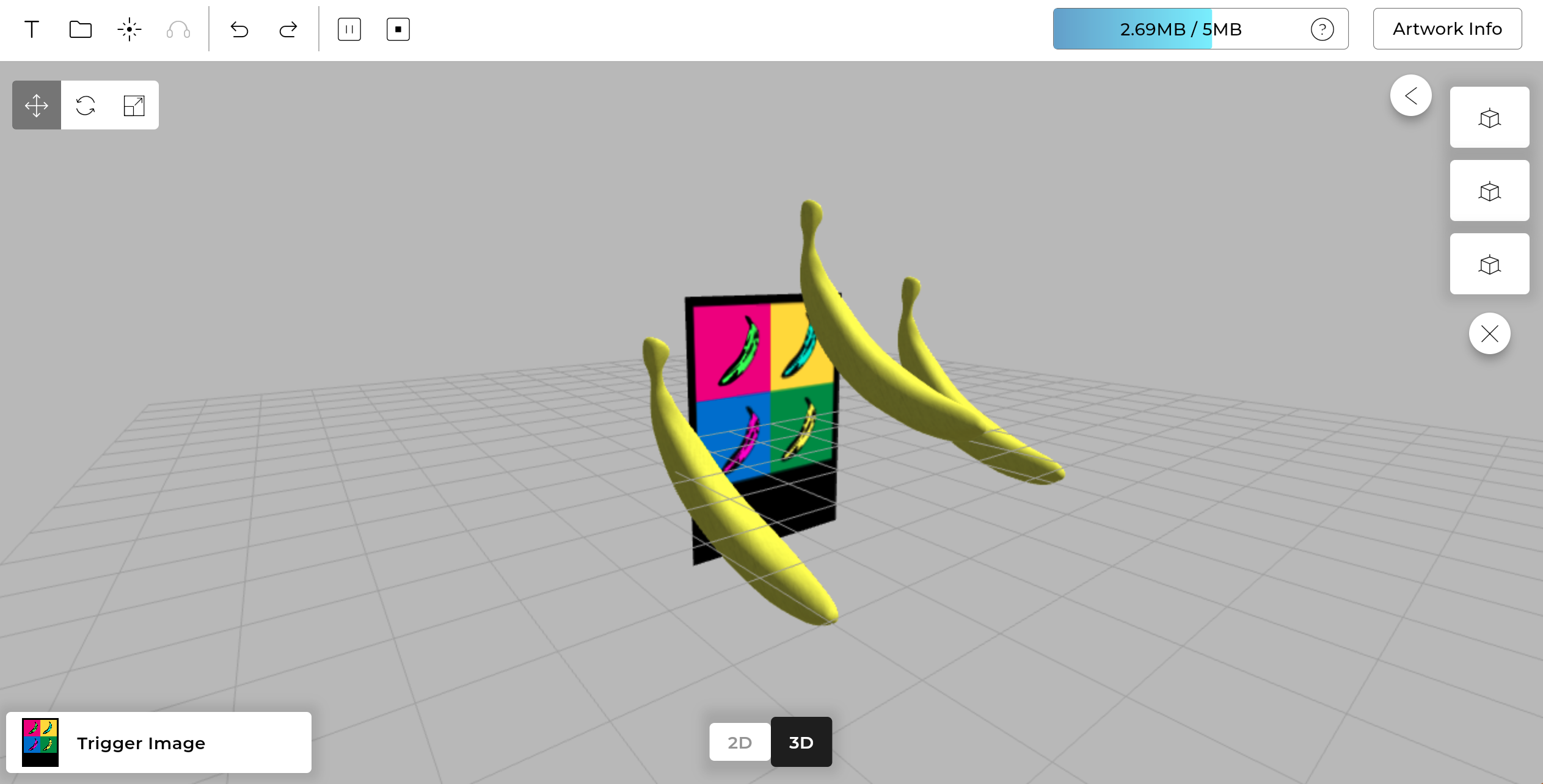

STEP 1: Start by adding your trigger image. Trigger image is an image that will show your AR creation when scanned through the Artivive App. It can be a photo, a drawing, or any picture you like.

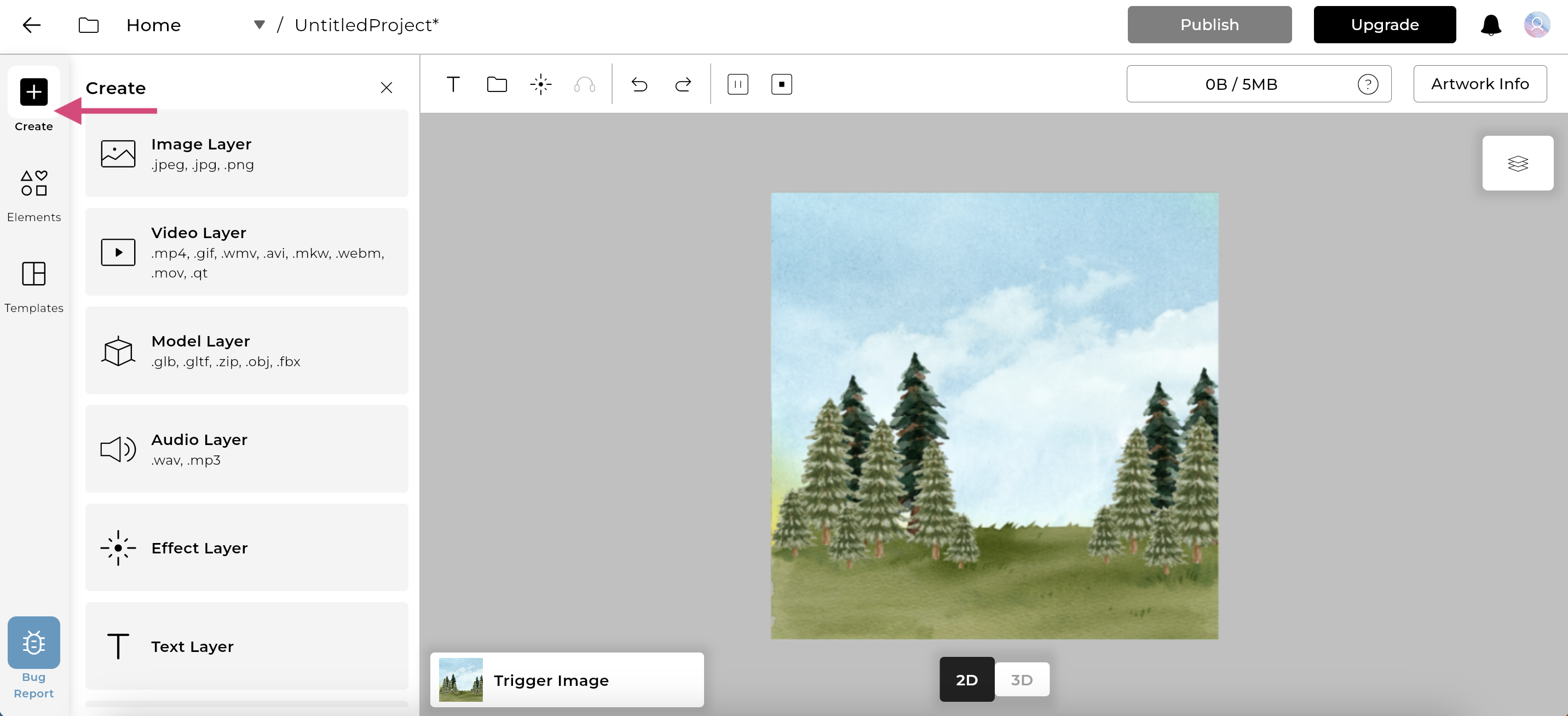

STEP 2: Let your imagination run wild. You can either:

a) Upload your own layers - you can use image, video, audio, or 3D object files:

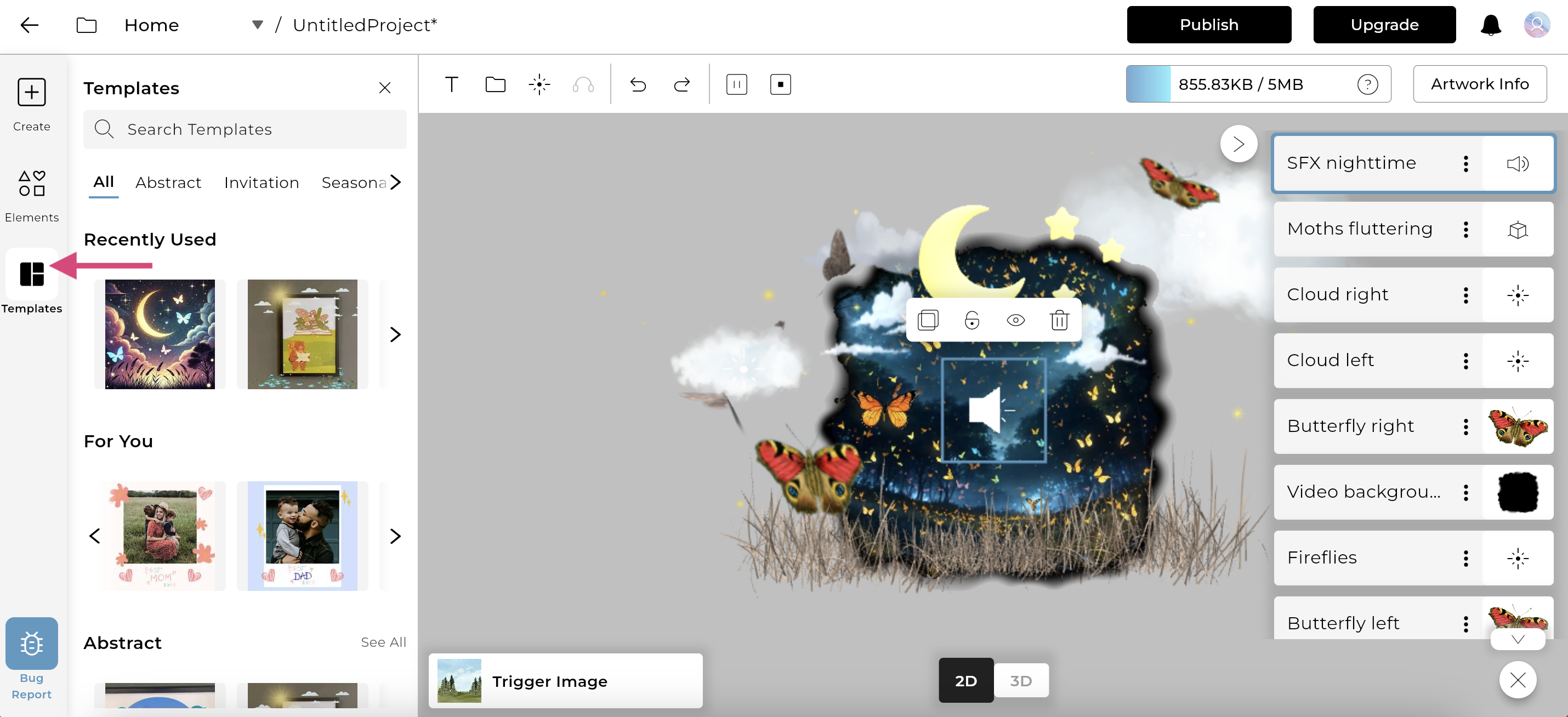

b) Try out our pre-made AR layer templates:

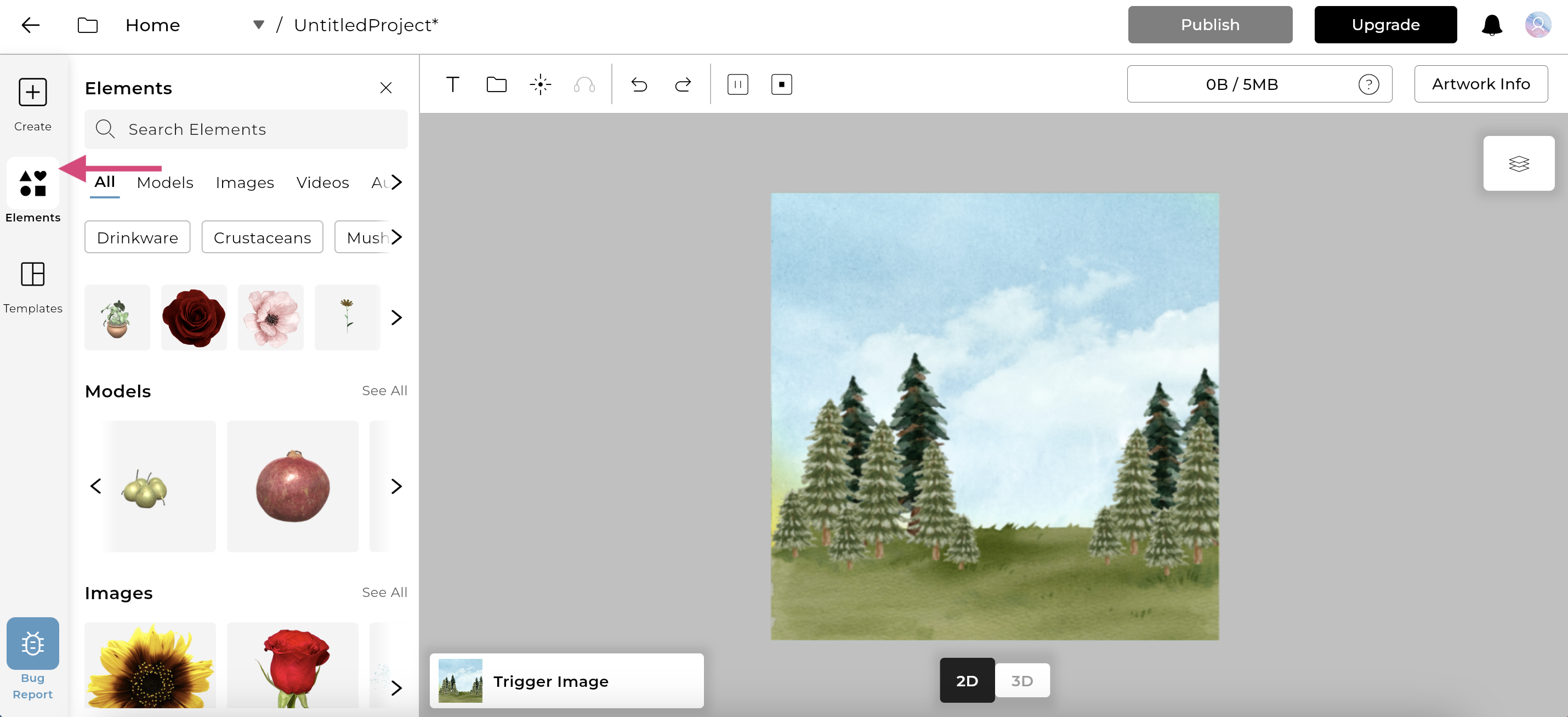

c) Browse through our elements library:

STEP 3: Toggle between the 2D and 3D view to have a better control of the AR experience you are creating. You can easily move, rotate, and scale your layers.

STEP 4: Name and publish your artwork.

STEP 5: Once the artwork is done processing, take out your phone, open the Artivive App, and watch your artwork come to life!

If you want to get more additional views to your account, there are two ways of doing this.

1. Upgrading the account

All our plans/subscriptions are monthly priced and can be changed or canceled at any time. To encourage long-term commitment we offer a discount of up to 35% for yearly plans. The monthly or yearly subscription will automatically renew. Please have a look at the overview of our subscriptions at Artivive‘s pricing page.

2. Additional views

The add-ons are one-time payments that can get you additional views for the current subscription month. Add-ons are available only for upgraded accounts – they won’t work for a Basic ACA.

- 2.000 views – € 39,90

- 5.000 views – € 59,90

- 10.000 views - €99,90

- 20.000 views – € 199,90

.png)

*To purchase more views for the month you will need to go to your profile account and in the dashboard, you will find the option to add more views.

3. Cost control

Cost control refers to setting an additional cost limit in your account. This means that after you used the views included in your plan, the artworks will still be active until the overage limit is used as well. You can set the cost control by visiting your profile on Bridge, clicking on “dashboard”, and scrolling down to the “cost control” bar.

You will only be charged if the view limit included in your plan has been reached, and only for the additional views that have actually been used (0,02 € per view). You can also set your cost control to 0,00 €, which means you will receive an email and pop-up message when the monthly view limit has been reached, and you will have the option to add additional views, upgrade your plan, or set the cost control then

For further information, check out all the Artivive Creator Account info.

Augmented reality helps artists go beyond the canvas and take advantage of the power of storytelling to create a more interactive and enhanced experience for the viewer.

You certainly want to connect with your viewers better, but perhaps it seems a little daunting. Isn’t Augmented Reality Art for tech-savvy artists?

This is where Artivive comes in. It’s an easy-to-use, affordable tool for creating Augmented Reality Art. Whether you are a beginner or expert, Artivive welcomes users of every artistic level.

To start creating, register for an Artivive account. This will give you access to our content management system called Bridge by Artivive.

If you are a creative looking to wow your audience, fill out this form on our registration page.

It’s time to fully experience the artwork by viewing its augmented reality extension.

- Download the Artivive app from the Google Play Store or Apple App Store and open the app on your phone or tablet.

- Point your device’s camera to the artwork and watch as it comes to life through the Artivive app.

- Tap on the screen while viewing an artwork to see any artwork information, as well as website and social media links added by the artist.

* All our subscriptions automatically renew depending on your subscription of choice

(monthly or yearly)

How to cancel subscription

You can cancel or downgrade your subscription at any time by visiting your Bridge profile dashboard and clicking on “manage subscription”. The change will occur in the next billing period.

Step 1: Go to your Bridge profile dashboard

Step 2: Click on “Manage subscription”

Step 3: Select “Unsubscribe” under your current plan – the changes will occur during your next billing cycle.

Pause subscription

If you would only like to deactivate your subscription for a short period, we offer you an option to pause your subscription.

You are able to pause your subscription for up to 3 months. You can do so by proceeding to unsubscribe and selecting the pause subscription option when offered. The subscription will automatically continue after the time period you paused it for ends.

Step 1: Same process as going to cancel subscription

Step 2: You will be asked if you would like to cancel or take a temporary break, see below:

HOW DOES THIS WHOLE THING WORK?

Our platform, Bridge, was created especially to be used with Artivive. It analyzes the image you upload in order to find its unique pattern – like a fingerprint. When the Artivive app recognizes the image, it starts playing the digital layer connected to it. At the same time, through the camera view, the recognized image is replaced in the real world by the animation/video/digital layer. The technology we are using is called augmented reality.

WHAT IS BRIDGE?

Bridge is our creator tool for you to create AR masterpieces. After you create your work in Bridge you can scan the physical work with the Artivive App.

HOW CAN I REGISTER FOR A BRIDGE ACCOUNT?

To register for an account, click here and fill out the short registration form. Once this is done, you will receive an email to activate your Bridge account and you can get started with creating your first augmented reality artwork!

HOW HARD IS IT TO CREATE A PROJECT?

It depends on the story you want to tell. We suggest that you start with a test: upload an image and a video that you already have. You can also use your smartphone for this test, just take a photo and record a short video to go with it. This won’t take more than five minutes and it will give you a better understanding of the whole process.

HOW DO I CREATE MY FIRST PROJECT?

Tap the “Add Artwork” button on the home screen, or the “Add Artwork” icon in the top right-hand corner. To begin, give your project a name and choose the folder you will work on – and then name your folder. Then drag and drop, or upload a JPG or PNG image and an MP4 video to create an augmented reality artwork. By clicking the “Publish” button, you will link the image and the video. Wait a few moments for the upload to be complete. Once the project is ready, it will appear in your “Artwork Collection”.

WHY DO I HAVE TO UPLOAD AN IMAGE AND A VIDEO?

Artivive needs a photo or image of your artwork in order to recognize it and extend it with the video/animation dimension.

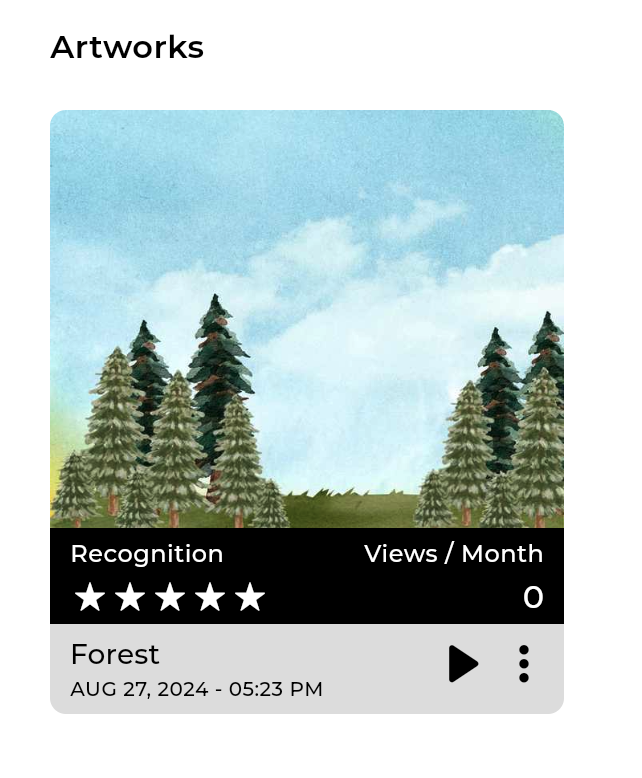

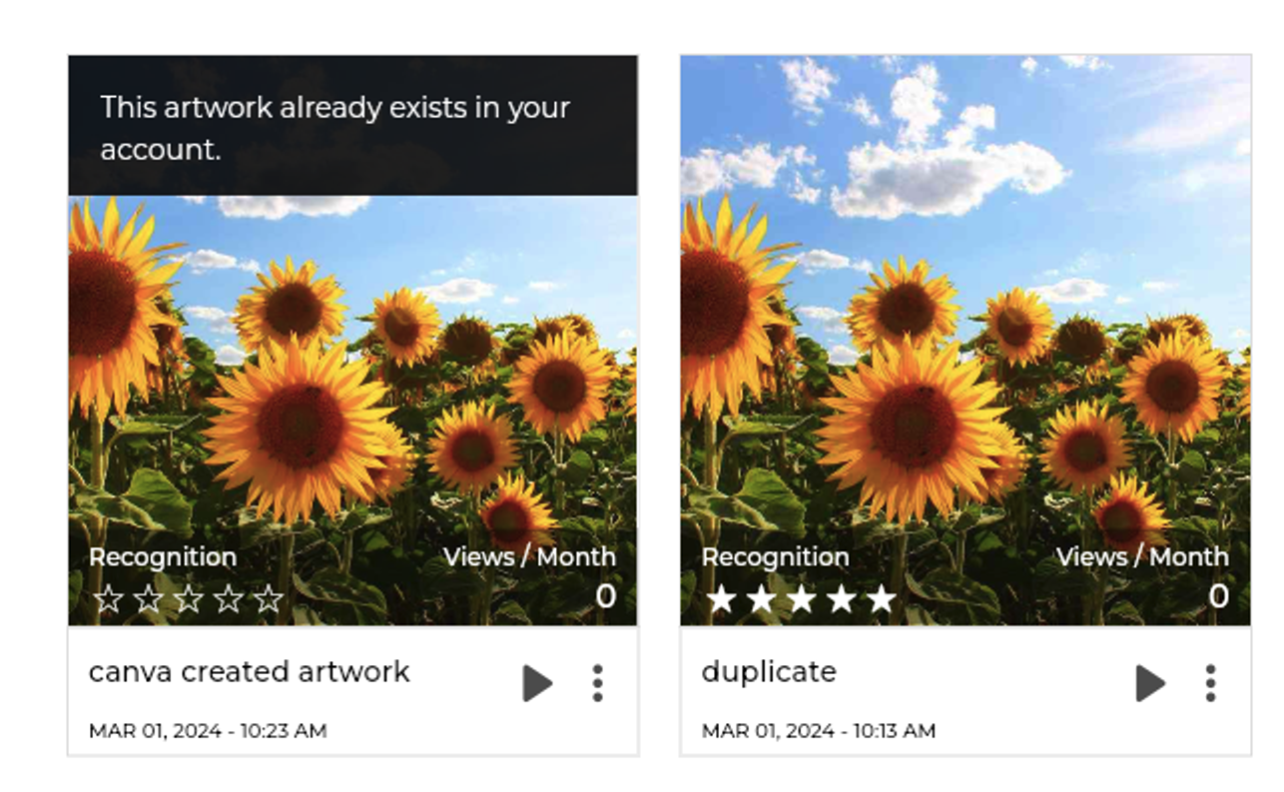

WHAT DO THE STARS IN THE PROJECT INFO MEAN?

Bridge analyzes the image you uploaded to find its unique pattern – like a fingerprint. The stars (0-5) tell you how suitable the image was for finding a unique pattern. Images with a higher contrast are easier to recognize. Images with very little to no detail, a single color, or that are very blurry, will not be suitable for Artivive. If you experience any difficulties, please contact us so that we can assist you.

CAN I ADD ADDITIONAL INFORMATION TO MY ARTWORK?

Yes, you can add information about your artwork on Bridge. To do so, click the “Artwork Info” button. Fill out your name, the name of your artwork, a brief description of it, and your social media handles. This information is visible to users when they press the “i” button on the Artivive app.

HOW WILL MY AUDIENCE KNOW THAT THEY SHOULD USE ARTIVIVE?

You can download templates with instructions for your audience here.

I WANT TO CREATE AR ART — HOW DO I REGISTER?

To register for an account, click here and fill out the short registration form. Once this is done, you will receive an email to activate your Artivive Creator Account. Then you can log into our content management system, Bridge, and start creating!

WHICH ACCOUNT SHOULD I CHOOSE?

Artivive offers one type of account with upgrade and add-on possibilities. This account is a freemium account – any creative can sign up and use it for free up to a certain number of scans (50 lifetime views). These are the following upgrades available:

- Pro – 1.000 views/month

- Pro Plus – 5.000 views/month

- Business – 15.000 views/month

- Custom – custom views/month

For prices and further features please log into Bridge.

HOW MUCH DOES IT COST?

The basic Artivive Creator Account is free. After that, you can choose between different tiers of Artivive subscription. You can find the prices on Artivive‘s pricing page. You can get a discount of up to 35% by opting to pay yearly:

Please note that our monthly subscriptions are automatically renewed each month unless you cancel during the subscription period, and our yearly subscriptions are automatically renewed each year.

HOW TO UNSUBSCRIBE?

Please go to Bridge and click on the “Upgrade” button. Then, under the Basic plan, there is a button “unsubscribe” – this will downgrade your paid account to a free one. The change will be reflected in the next billing cycle.

WHAT HAPPENS AFTER MY 14-DAY FREE TRIAL OF THE PRO SUBSCRIPTION?

After the 14-days, your account will automatically continue the Pro subscription unless canceled beforehand (you can cancel the trial at any point before it ends, and still use it for the whole 14 days).

WHAT IS THE DIFFERENCE BETWEEN COST CONTROLLING AND ADD-ONS?

For cost control, the user can set an additional cost limit for the account/month. This will be the amount until the account can be charged for over-usage (more views than in the upgrade). The amount can also be 0. It works on a subscription basis.

The add-ons are one-time payments that can get you additional views for the current subscription month. They start from 2.000 views and can reach up to 20.000. Add-ons are available only for upgraded accounts – they won’t work for a Basic ACA.

WHERE ARE MY INVOICES?

You can access your invoices on Bridge by clicking on your account information and then on the button “Invoices”.

I FORGOT TO CANCEL MY SUBSCRIPTION ON TIME. DO I GET A REFUND?

If you forget to cancel before the renewal date we may, under exceptional circumstances and without prejudice, apply a credit to a future purchase. No refunds will be issued.

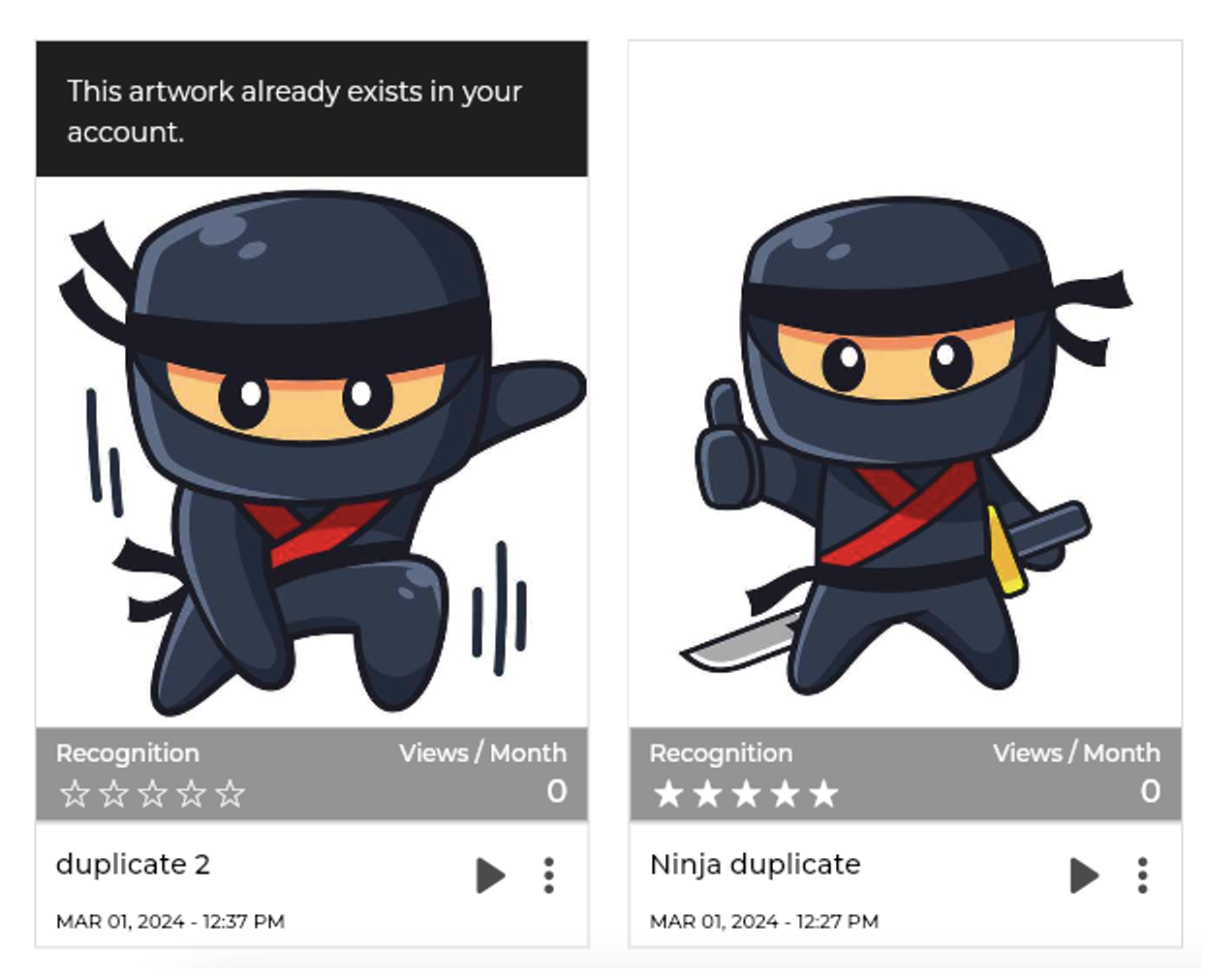

A duplicate message appears when you upload an artwork, and our system finds the same (or a very similar image) already in our database.

A duplicate artwork can happen for many reasons:

- Identical artworks uploaded to the database

- Text, font and logos repeating throughout multiple artworks

- Similar characters throughout multiple artworks

- Repetitive symbols throughout multiple artworks

Pro Tip: Think of your artwork like a fingerprint. No two fingerprints share any similarities and they are entirely unique from one another.

- Example of identical artworks:

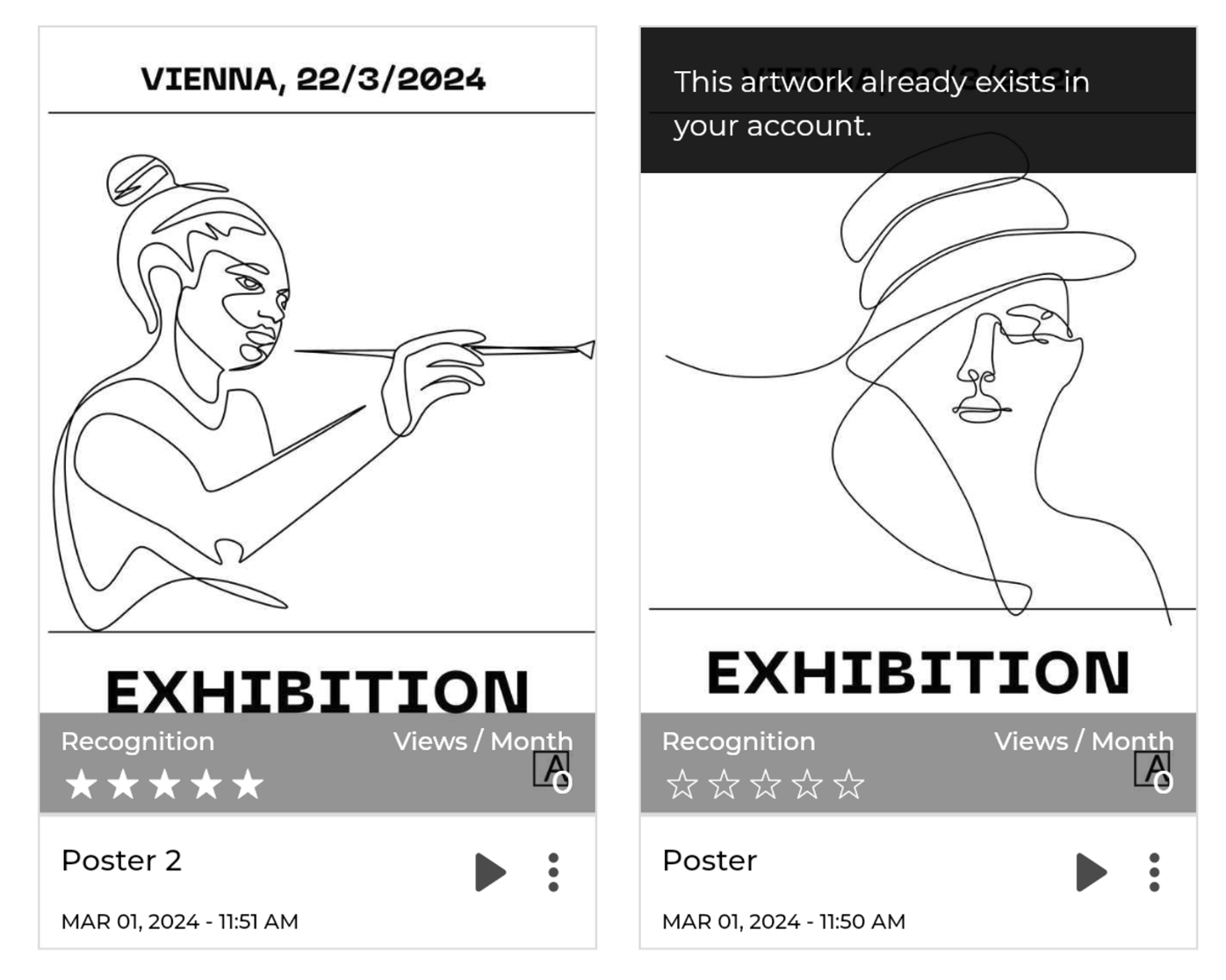

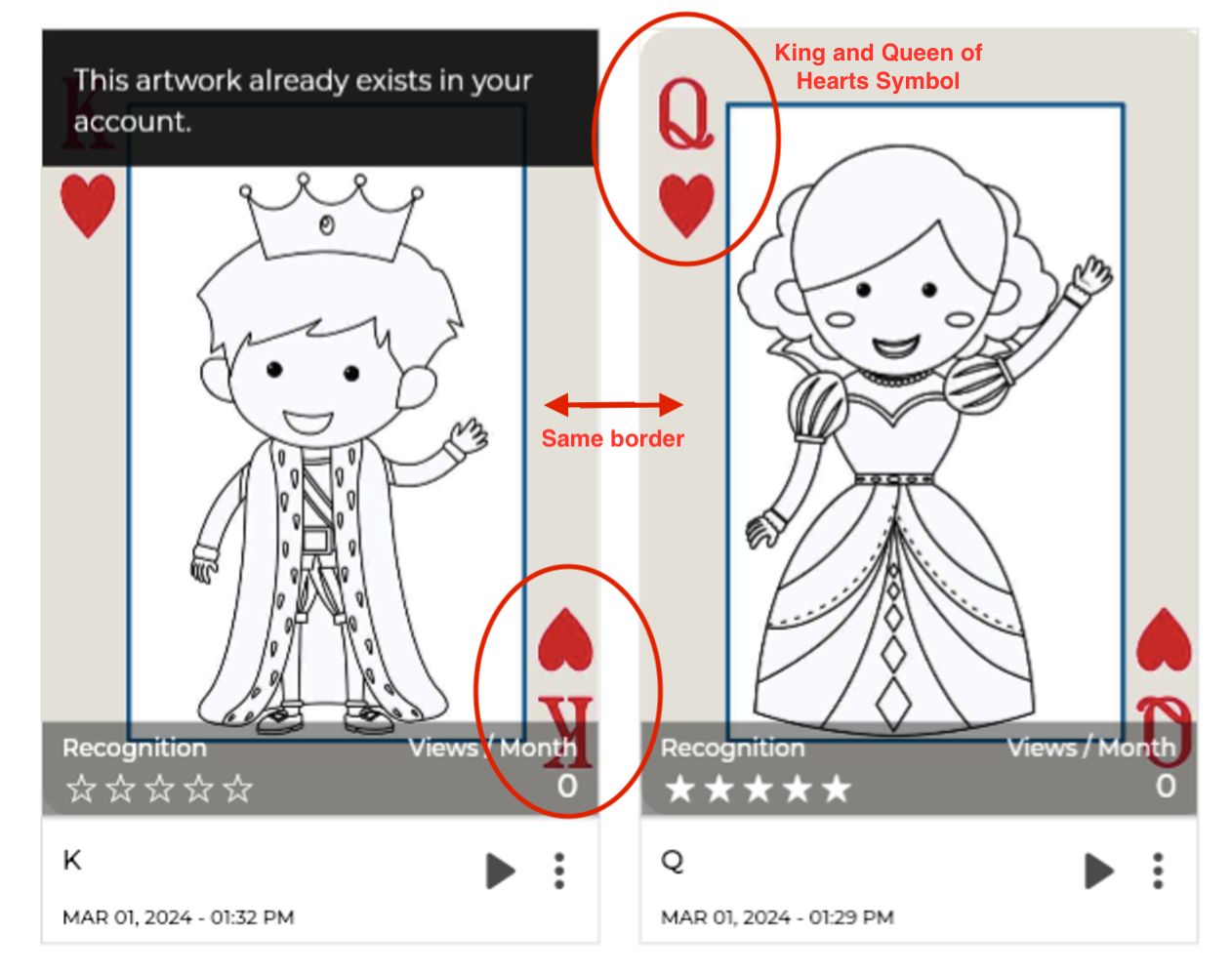

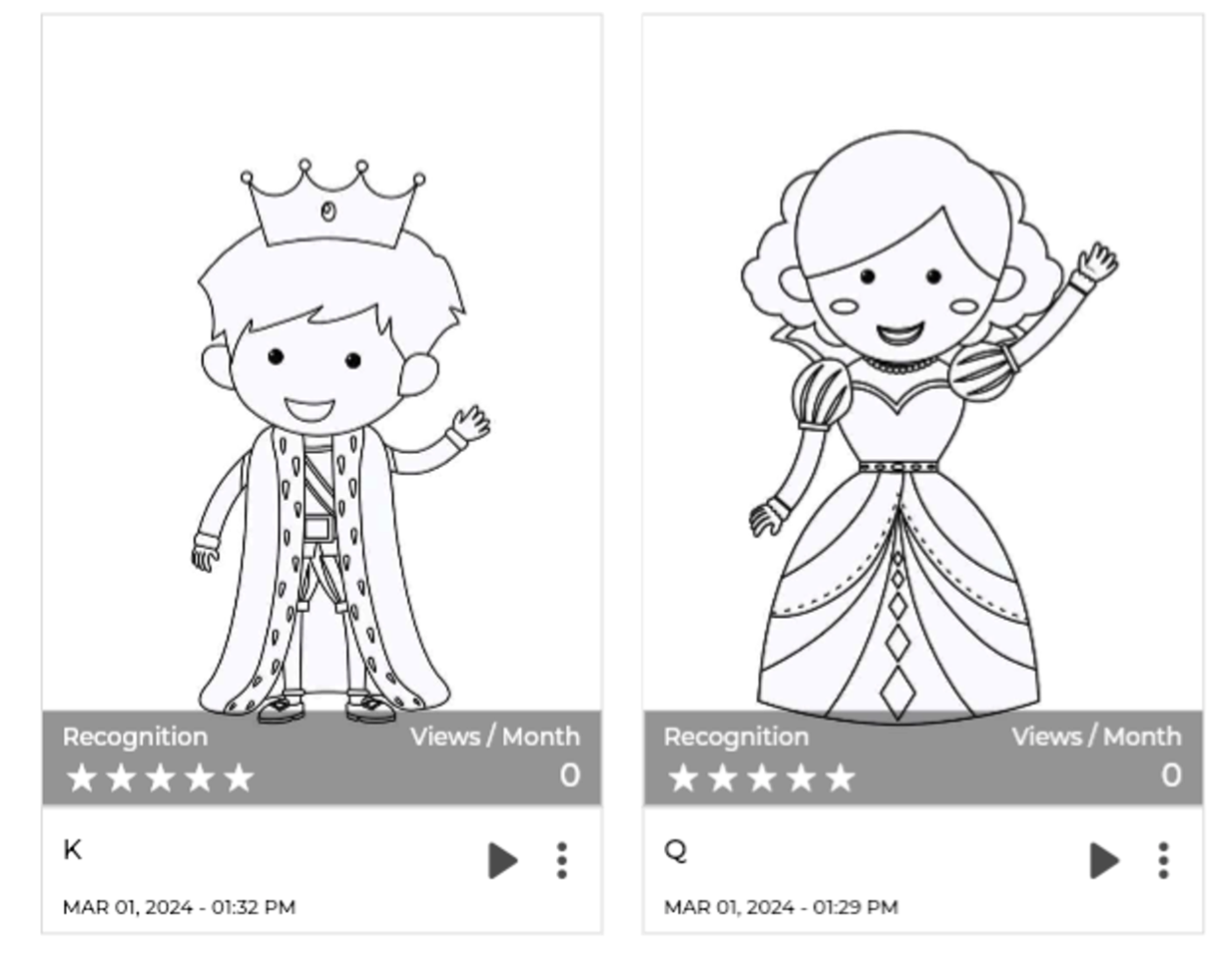

2. Example of text, font and logos repeating throughout multiple artworks:

These two posters contain the same text and logo so it has appeared as a duplicate. In the next example you will see the same poster uploaded but without the text and logo and it will be approved.

3. Example of similar characters throughout multiple artworks (very similar but different):

Although these two artworks are not exactly identical and the character is in two different positions, the artwork is share too many similarities and therefore pronounced a duplicate.

4. Example of repetitive symbols/elements throughout multiple artworks:

Similar to the example of text and logos, symbols shared between artworks can also cause duplicates.

Removing the repetitive elements (example: the border, and the King and Queen of hearts symbols) can help resolve the duplicate problem and make the artworks unique.

Tips and tricks:

- Try to eliminate these elements from all the artworks and leave the space blank. In most cases, it’s enough if you remove the duplicate elements only in the images you upload to Bridge Don’t worry, you don’t to remove these elements from the physical work.

- Don‘t use a very popular artwork or symbols, there is a higher chance of it being a duplicate.

- Are you working with somebody else on this project, have they already uploaded this image in a different account? If so, you should get in touch with them.

- Do you think somebody is using your own work and is therefore violating copyright laws? If so, please get in touch with us and let us know which artwork is affected. We will get in touch with the other artist(s) and solve the issue.

If you have any questions don’t hesitate to reach out to us at support@artivive.com

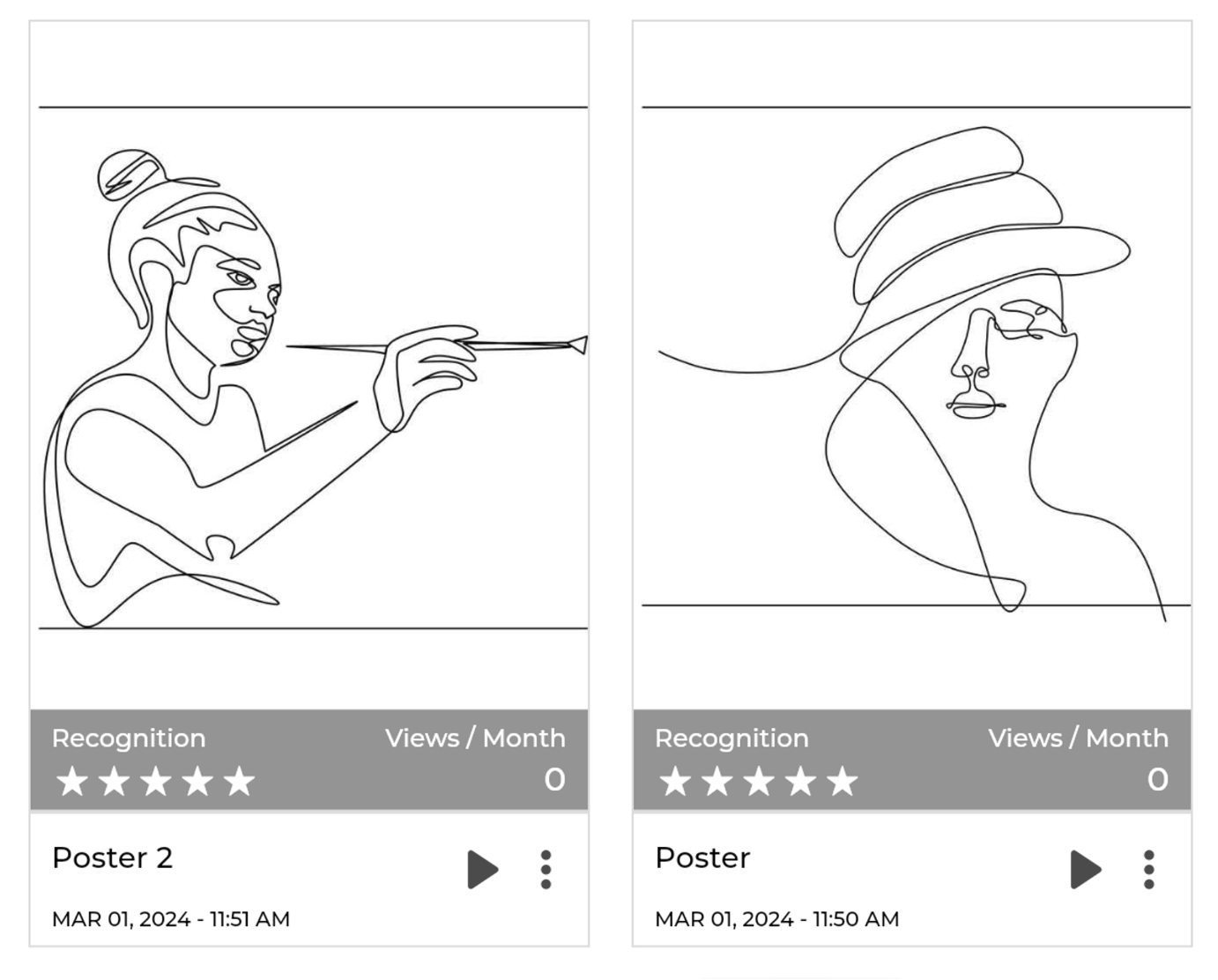

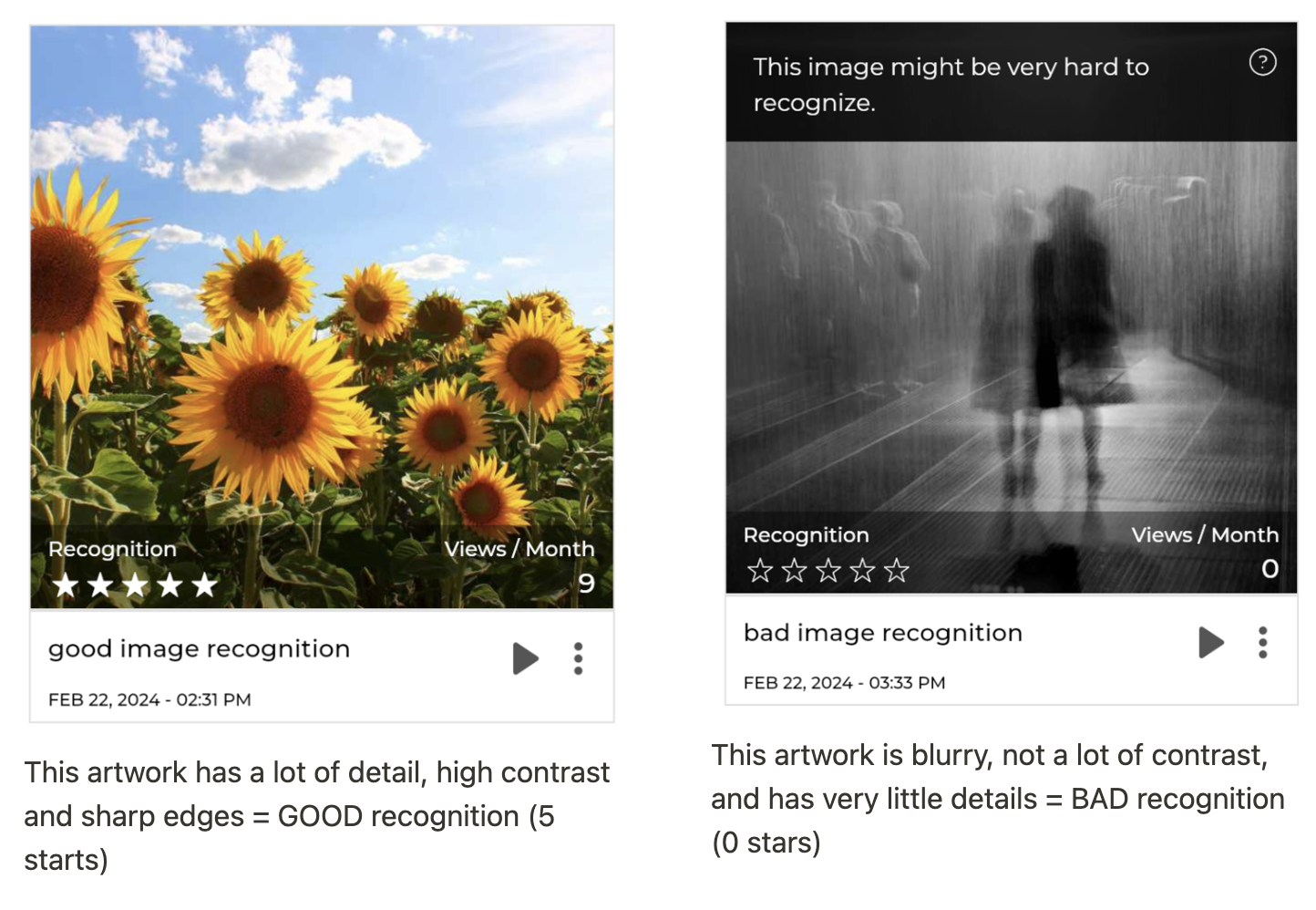

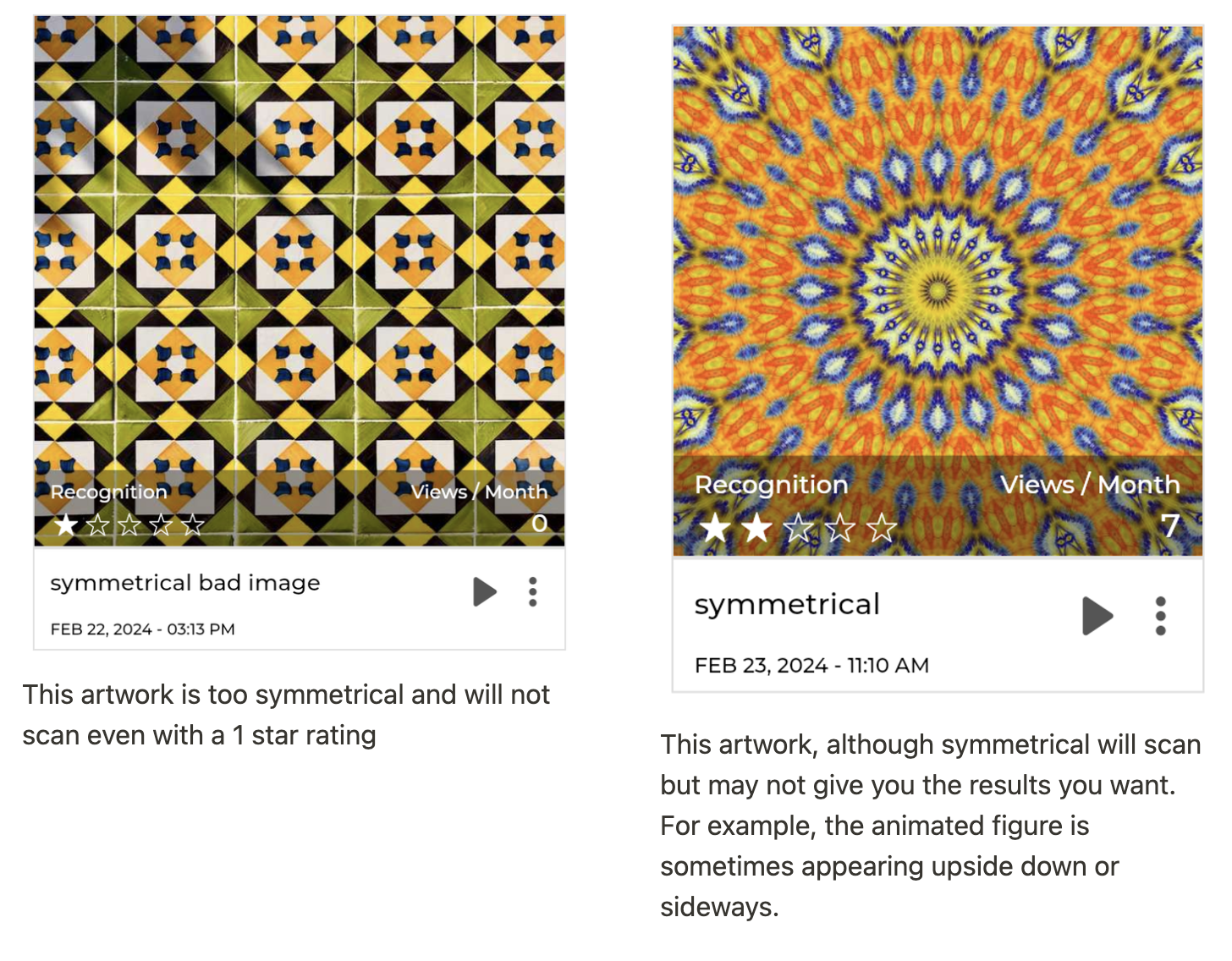

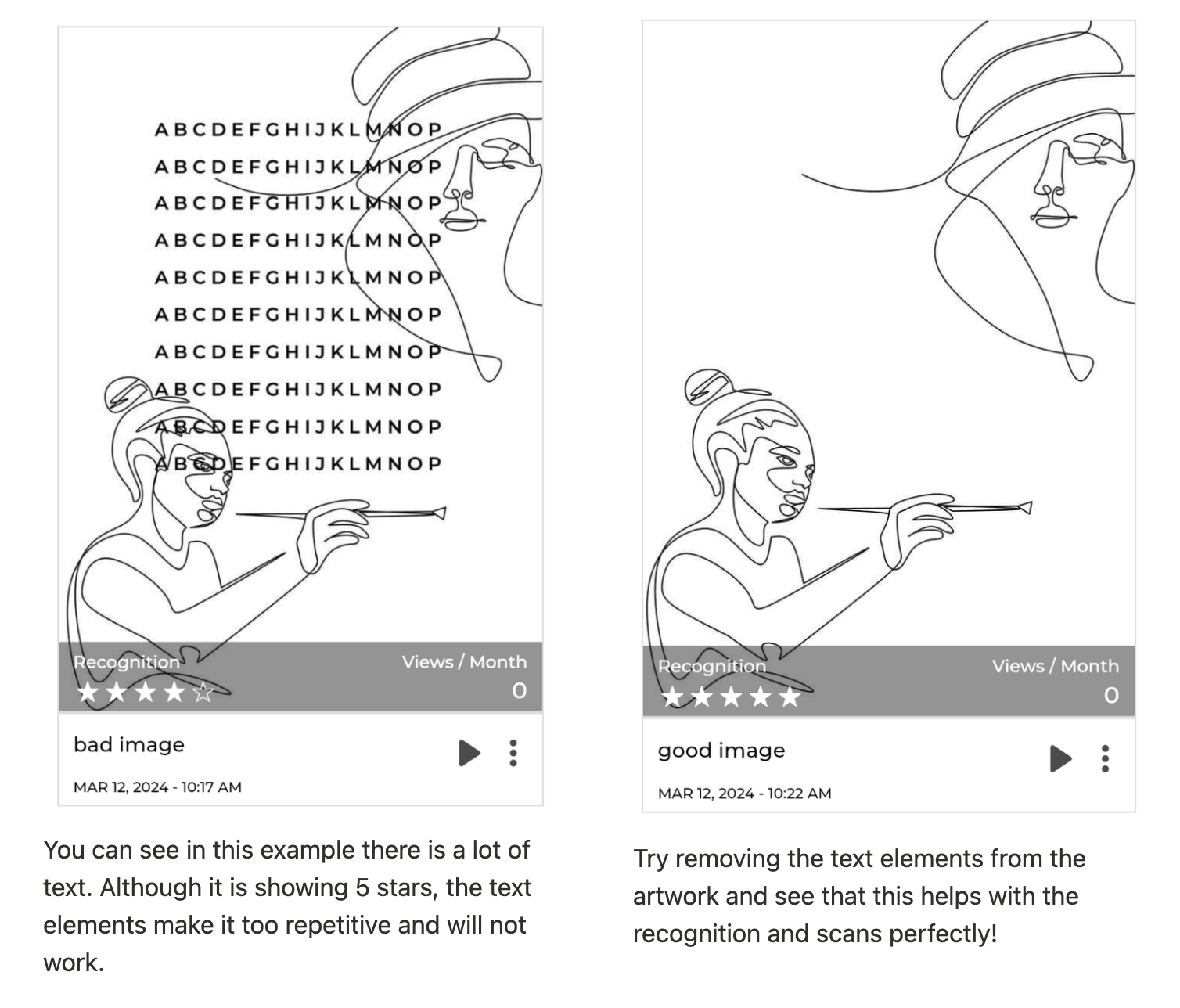

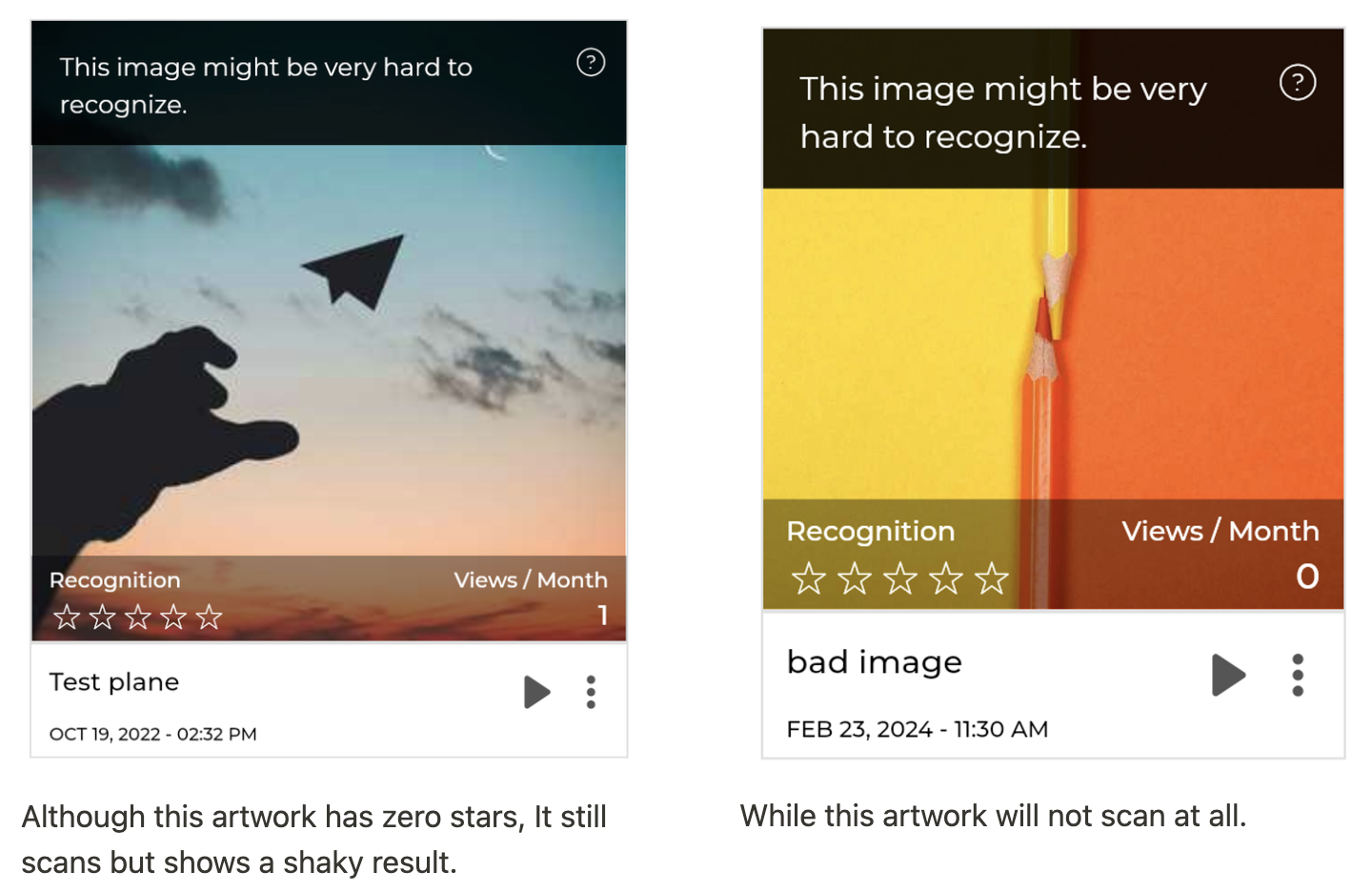

How it works: Bridge analyzes the image you have uploaded to find its unique pattern – like a fingerprint. The 0 – 5 star rating is to give you guidance for the best possible result in scanning the artwork with the Artivive App.

*The star rating is not fault-proof. They are just an indication of the number of reconizable features that are present in the overall composition. But, if those features are symmetrical, or just circles, the tracking will be harder to work.

Check list for GOOD image recognition:

✅ High contrast

✅ Plenty of detail

✅ Sharp edges

What can cause a BAD image recognition:

❌ Solid single colors

❌ Very little to no details

❌ Blurry images

❌ Too symmetrical

❌ Too much text

PRO TIP: Always test your projects before printing!

Clear examples of GOOD and BAD recognition:

Further examples of what to look out for when it comes to BAD image recognition:

Try scanning these two artworks for an example of a low star recognition that has repetitive patterns resulting in an unreliable scanning experience:

Example of BAD image recognition from having too much text:

More examples of bad image recognition (0 stars):

Watch this tutorial for further reference on how to optimize image recognition.

If you need any further assistance, reach out to us at support@artivive.com

WHAT FILE TYPES ARE SUPPORTED BY BRIDGE?

The file types that are compatible with Bridge are .jpg and .png files for images and any video files (eg .mp4, .gif, .MOV). For 3D objects, the files compatible are glTF and GLB.

WHAT ARE THE REQUIREMENTS FOR THE IMAGES AND VIDEOS USED?

For images and 3D objects, the maximum file size is 3MB (holders of Pro subscription) or 5MB (holders of Pro Plus and Business subscription). For videos, the maximum file size is 100MB. For the target image, the longer side must be between 380 and 8000 pixels.

We have no length restrictions for the videos, but we recommend to keep it under 45 seconds.

WHAT DOES THE OVERALL SIZE LIMIT OF 3MB FOR A PROJECT MEAN?

There are 2 different type of limits (independent of each other):

- Up to 3 (unique) videos with each one up to 100 MB

- Up to 3 MB for all non-video layers (images and 3D models, trigger image not included in this count) – for holders of Pro subscription

- Up to 5 MB for all non-video layers – for holders of Pro Plus or Business subscription

Note: All files are compressed upon uploading/saving your project. Except for already compressed 3D objects.

I DON’T KNOW HOW TO PRODUCE A VIDEO!

Of course you do! We are certain that you have already filmed something with your smartphone. That’s all you need to start creating. That being said, if you’re looking to level up your skills, there are many resources and tutorials available online on how to edit and process videos, which can help you implement your idea. Check out some tutorials here.

SHOULD MY VIDEO HAVE SOUND?

Sound extends the experience of your AR artwork. If you are creating for an exhibition and are concerned that this might disturb other visitors, you can set it so it will only play over headphones. By clicking the “headphone” button, you can activate or deactivate the option to play the sound only over headphones. If your video has sound, this will be played and can be heard, provided that the user’s smartphone is not on mute.

CAN I MAKE MY VIDEO TRANSPARENT ON BRIDGE?

Videos can be made transparent by selecting a color to be eliminated, either by using the color-picker tool or by entering the color’s value. You can also adjust the threshold to set the transparency level. Uploading an already transparent GIF is also supported.

WHY IS IT NOT OPTIMAL IF THE VIDEO IS LONGER THAN 45 SECONDS?

In order to view artworks, users must hold their devices upright and point the camera at the artwork. We have found that after 45 seconds, it becomes tiring and the focus shifts from viewing and enjoying the artwork to maintaining a steady hand. Therefore, we suggest making videos that have a length of under 45 seconds. There are no restrictions though, so you can make a video longer, just keep this in mind.

CONVERTING IMAGES AND VIDEOS INTO THE RIGHT FORMAT

You can easily convert the image format by using a variety of free tools such as this one for .jpg images or this one for .png images.

ARE 3D OBJECTS SUPPORTED ON BRIDGE BY ARTIVIVE?

Yes! We now support 3D objects. The files compatible are glTF and GLB. Files can also be uploaded in a zip archive.

WHAT DEVICE DO I NEED TO USE THE ARTIVIVE APP?

All you need is a smartphone or a tablet. You can download the app for free from the Google Play Store or Apple App Store.

HOW CAN I VIEW THE DIGITAL LAYER OF AN ARTWORK?

Open the app and point your device’s camera to the artwork extended with Artivive, and watch as it comes to life through the Artivive app.

WHY WON’T THE VIDEO PLAY THROUGH THE ARTIVIVE APP?

Only artworks created in Bridge are compatible with the Artivive App.

HOW DOES THE SHARING FEATURE WORK?

When viewing an artwork through the app, a record button will appear, which allows you to record a portion of the animation/video. Once the recording is complete, you can either share it or ask to send it to the Artivive feed for approval.

WHY IS THERE A LIMIT OF 10 SECONDS IN THE VIDEO RECORDING FUNCTION?

We limited the recording time to 10 seconds, so people can share something like a trailer of the artwork. The AR extension of artworks made with Artivive can be experienced in full by seeing the analog artwork and scanning it with the app. This limit was requested by our artists, to allow viewers to share a teaser of the experience with others while protecting the artist’s works.

HOW CAN I PROMOTE MY ARTWORKS ON YOUR SOCIAL MEDIA CHANNELS?

For a chance to get featured on our social media channels, click here to submit details about your event, project, or artwork. We look forward to featuring your art!

WHAT TO KNOW ABOUT 3D OBJECTS IN BRIDGE

WHAT FILE TYPES ARE SUPPORTED FOR 3D OBJECTS?

For 3D objects, the files compatible are glTF and GLB (works best) otherwise, .obj and fbx files work too. You can also upload your files as a zip.

WHAT SHOULD BE INCLUDED IN THE ZIP FILE?

If uploading your 3D object as a zip file make sure that all textures (if jpeg or png) are included otherwise your textures will not be seen

WHAT SIZE SHOULD MY 3D OBJECT BE?

The maximum file size for 3D objects is:

- 3MB for holders of Pro subscription

- 5MB for holders of Pro Plus or Business subscription

*For the best results export your object from Blender.

If working outside blender, you can import into blender and export from there to get the best results!

BEST WAYS TO EXPORT FROM BLENDER:

- Export as: gltf (works best) .obj, fbx files work too

- Format: binary – textures (all the textures and colours that are on the model are already there), Otherwise you need to .zip

- Make sure to select:

- Compression – always make it smaller

- Animation (if included) – select so it’s also exported with model

HOW TO KEEP UNDER 3MB (in Blender) –

Go to Modifiers -> decimate (this reduces the vertex/face count of the mesh (object) and keeps the model smaller)

Textures – image texture (reduce the colour texture) -reduce in photo shop. Color found within blender also work.

HERE ARE SOME EXAMPLE FILES FOR YOU TO PLAY WITH

*If you have any questions or need any further support feel free to write an email to us at support@artivive.com

WHY HAVEN’T I RECEIVED AN ACTIVATION LINK AFTER REGISTRATION?

Please check your spam folder — if the email still isn’t there, let us know and we will help you solve the issue.

WHY IS MY VAT NUMBER NOT BEING ACCEPTED?

You can check if your VAT number is within the European guidelines here. Our platform accepts only VAT numbers that are recognized by the official system. Please, also make sure that your VAT number and company name are connected accordingly to one another.

WHY DO SOME PROJECTS TAKE LONGER TO UPLOAD THAN OTHERS?

Depending on your location, internet connection, and the size of the video, or more added layers, it can sometimes take longer. We are constantly working on expanding our servers and network to give you the best experience.

Our community is growing and we want to give you a place to share your work, exchange ideas and connect with other artists. Join our Augmented Reality Art Facebook Group.

You can find more AR projects in the community here.

From murals to exhibitions, books, and online installations, our community is constantly creating more and more wonderful projects.

In order to stay up to date with them, we created a document that serves as our own “database”.

Check it out here.

We want to give back to our community by presenting your upcoming exhibitions, videos, or pictures of your Artivive-enhanced artwork on our social media platforms. For a chance to get featured, just fill out the form below!

Don’t forget to follow us on social media for news and updates! Our handle is @artiviveapp.

#bringArtToLife #Artivive

- Why using augmented reality in museums: DOWNLOAD PDF

- AR and Street Art: DOWNLOAD PDF

- Illustration Tools List: DOWNLOAD PDF

- Animation Tools List: DOWNLOAD PDF

- 3D Tools List: DOWNLOAD PDF

Get inspired and don’t forget to follow us on Instagram for news and updates!

@artiviveapp #bringArtToLife #Artivive

An easy-to-understand set of directions to guide visitors on how to experience the augmented reality part of the exhibition is the perfect way to create a seamless and successful event.

Check out our easy to download templates:

Keep it simple and offer an overview

We’ve designed some easy-to-use templates to help you get the most out of your augmented reality exhibition. Our templates are both free to download and easy to implement.

Customize to suit your needs

Create a flyer for your event, add directions on how to view the AR layer for your exhibitions, or include guidelines for your digital and print artworks. No need to hire a graphic designer — easily customize our templates to suit your needs and print them.

Here you can find our templates that can be used for your exhibition, art installation, or street art.

An easy to understand information to guide the visitors how to experience the Augmented Reality part of the exhibition is the perfect way to create a successful event.

Keep it simple and offer an overview using any of these templates designed to help you get the most out of your Augmented Reality exhibition. Our templates are both free to download and easy to use.

Create a flyer that conveys your event’s details, use our logo next to your artworks, print guidelines on your postcards and get some great feedback from your visitors. No need to hire a graphic designer – just easily customize our templates and print them.

We have created a special guide that will help you integrate our templates into your museum’s exhibitions. From wall stickers to flyers, you can find everything you need here in order to create the best experience for your audience.

Click here for more.

No matches found

Artivive Shop Pricing & Taxes

What is the product’s retail price?

The retail price is the amount the customers are charged for a product. The retail price is determined by the minimum price which includes production, shipping and a handling fee plus the artist share.

Depending on the billing address and the laws of the respective country the retail price will vary.

Do Artivive’s product prices include tax?

The prices you see on our product pages include applicable tax, prescribed by the Austrian tax law. The final price you pay will be calculated in the checkout based on the country’s regulations and laws of the shipping address and may be different from the listed price.

Customers inside EU:

The amount of VAT to be charged is based on the regulations and laws of the respective country. VAT charges for your order will be itemized on the last page of your order, in the e-mail confirmation of your order and on the invoice dispatched with your order.

Customers outside EU:

For dispatch to countries outside the EU you may be charged VAT, or other taxes, as required by the country of delivery or alternatively, the packages may be assessed for import or customs fees, depending on the laws of the country concerned.

If customs or import duties are levied, these are payable once the package reaches the destination country. Additional charges for customs clearance will have to be borne by the recipient. We have no control over these charges and can’t predict what they might be. Customs regulations vary greatly from country to country. For further information please contact your local customs authority.